The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

Category: News and Trends

Quote

“MBA’s new policy initiative serves as a perfect foundation to level the playing field. The mortgage industry has a responsibility to promote minority homeownership by partnering with key stakeholders to remove barriers and support financial education and counseling, with a goal to close the racial homeownership gap and increase generational wealth among minority households.”

–Susan Stewart, 2021 MBA Chair and CEO of SWBC Mortgage Corp. San Antonio, Texas.

Quote

“MBA’s new policy initiative serves as a perfect foundation to level the playing field. The mortgage industry has a responsibility to promote minority homeownership by partnering with key stakeholders to remove barriers and support financial education and counseling, with a goal to close the racial homeownership gap and increase generational wealth among minority households.”

–Susan Stewart, 2021 MBA Chair and CEO of SWBC Mortgage Corp. San Antonio, Texas.

MBA CONVERGENCE Partner Profile: David Dworkin, National Housing Conference

One in a recurring series about MBA CONVERGENCE, the Mortgage Bankers Association’s affordable housing initiative.

MBA Advocacy Update Sept. 20 2021

On Tuesday, following months of MBA advocacy, the Treasury Department and FHFA suspended certain limits on the business activities of the GSEs. On Wednesday, FHFA also announced a Notice of Proposed Rulemaking to amend the Enterprise Regulatory Capital Framework Rule.

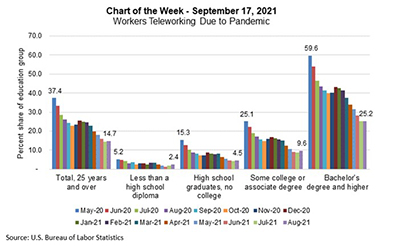

MBA Chart of the Week Sept. 17 2021–Teleworking Due to Pandemic

The COVID-19 pandemic has forced many businesses to change the way they operate, and even 18 months later, there are different views and strategies for the workplace, with teleworking at the center of many discussions.

Armand Massie of HCL Technologies: Transforming Lending Solutions for Enhanced Customer Experience

The face of lending has changed – from large banks and financial institutions to online consumers and lenders. With the pandemic mandating social distancing and lockdowns, businesses and individuals are looking for lenders that can perform the borrowing journey remotely and faster than before.

State of Construction Finance: An Interview with Rabbet CEO Will Mitchell

Rabbet, Austin, Texas, a service provider to lenders and developers engaged in construction recently released its 2021 State of Construction Finance report. MBA Newslink interviewed Rabbet CEO Will Mitchell to get a sense of what’s happening in the world of construction.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

MBA Annual21: ConcertMBA Presents OneRepublic to Benefit MBA Opens Doors Foundation

OneRepublic will take the stage for Concert MBA at the Mortgage Bankers Association’s Annual Convention & Expo to benefit the MBA Opens Doors Foundation.