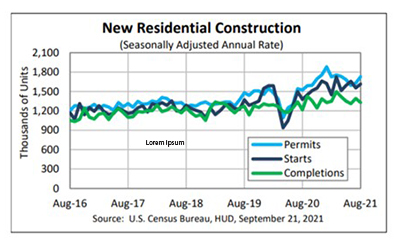

Home builders liked what they saw in August—HUD and the Census Bureau said August housing starts rose by nearly 4 percent from July, almost entirely by multifamily activity, and by more than 17 percent from a year ago.

Category: News and Trends

Dealmaker: Google to Acquire New York Office for $2.1B

Google announced it will purchase St. John’s Terminal in Manhattan for $2.1 billion.

Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 3

Data is the “dark matter” of M&A events. Data is made even more important with widespread digital transformations of processes, predictive analytics, and advanced machine learning. During an M&A event, the cascading challenges to leverage these siloed data innovations across Industry 4.0 ecosystems requires a framework that moves beyond the prescriptive, one-size-fits-all strategy.

MBA: August New Home Applications Up 9% From July, Down 17% from Year Ago

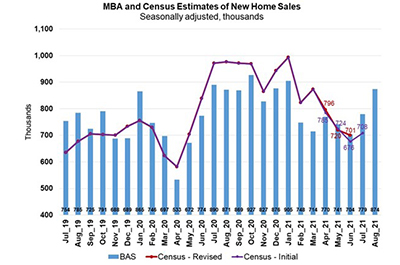

The Mortgage Bankers Association’s latest Builder Applications Survey reported mortgage applications for new home purchases increased by 9 percent in August from July but decreased by 17 percent from a year ago.

MISMO, Snapdocs Announce Collaboration on New e-Eligibility Service

Partnership will deliver first-ever centralized repository for digital closing acceptance criteria to help lenders more easily adopt digital mortgage closings

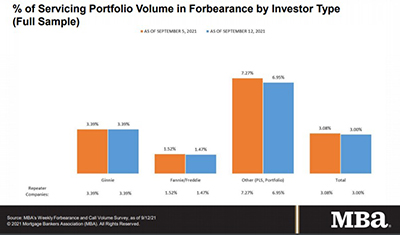

Share of Mortgage Loans in Forbearance Falls to 3.00%

Mortgage loans in forbearance fell to yet another post-pandemic low and threatened to fall under 3 percent for the first time in more than a year and a half, the Mortgage Bankers Association reported on Monday.

Brian Vieaux of AXIS Lending Academy: Diversity is Key to Success in Real Estate Finance

Brian Vieaux is a director of AXIS Lending Academy. He is also the president and COO of FinLocker, a provider of next-generation, digital, consumer-permissioned personal financial assistance tools. He has three decades of home lending experience and has held leadership roles at Citigroup, Flagstar and IndyMac Bank.

Quote

“Housing demand is strong heading into the fall, despite fast-rising home prices and low inventory. The inventory situation is improving, with more new homes under construction and more homeowners listing their home for sale.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

MBA Announces Policy Initiative to Close Racial Homeownership Gap

The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

MBA CONVERGENCE Partner Profile: David Dworkin, National Housing Conference

One in a recurring series about MBA CONVERGENCE, the Mortgage Bankers Association’s affordable housing initiative.