The face of lending has changed – from large banks and financial institutions to online consumers and lenders. With the pandemic mandating social distancing and lockdowns, businesses and individuals are looking for lenders that can perform the borrowing journey remotely and faster than before.

Category: News and Trends

Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 3

Data is the “dark matter” of M&A events. Data is made even more important with widespread digital transformations of processes, predictive analytics, and advanced machine learning. During an M&A event, the cascading challenges to leverage these siloed data innovations across Industry 4.0 ecosystems requires a framework that moves beyond the prescriptive, one-size-fits-all strategy.

MISMO, Snapdocs Announce Collaboration on New e-Eligibility Service

Partnership will deliver first-ever centralized repository for digital closing acceptance criteria to help lenders more easily adopt digital mortgage closings

Brian Vieaux of AXIS Lending Academy: Diversity is Key to Success in Real Estate Finance

Brian Vieaux is a director of AXIS Lending Academy. He is also the president and COO of FinLocker, a provider of next-generation, digital, consumer-permissioned personal financial assistance tools. He has three decades of home lending experience and has held leadership roles at Citigroup, Flagstar and IndyMac Bank.

MBA Announces Policy Initiative to Close Racial Homeownership Gap

The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

MBA CONVERGENCE Partner Profile: David Dworkin, National Housing Conference

One in a recurring series about MBA CONVERGENCE, the Mortgage Bankers Association’s affordable housing initiative.

State of Construction Finance: An Interview with Rabbet CEO Will Mitchell

Rabbet, Austin, Texas, a service provider to lenders and developers engaged in construction recently released its 2021 State of Construction Finance report. MBA Newslink interviewed Rabbet CEO Will Mitchell to get a sense of what’s happening in the world of construction.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

MBA Weekly Applications Survey Sept. 15, 2021: Refis Rebound; Purchase Applications Highest in 5 Months

After laying low for a while, refinance applications came roaring back last week, while purchase applications reached their highest level since April, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending September 17.

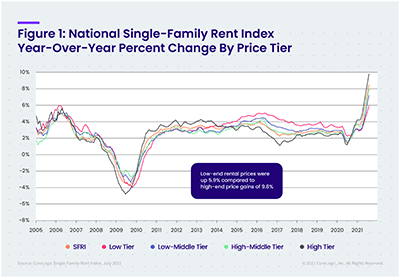

Single-Family Rent Growth Reaches Another Record

CoreLogic, Irvine, Calif., said single-family rent growth reached 8.5 percent year-over-year in July, up from a 7.5 percent year-over-year rate in June