Are new housing policies focused on making homeownership affordable and sustainable enough? Decades of continued discrimination due to lack of equal access for minorities responsible for the ever-growing housing gap would suggest not.

Category: News and Trends

Roxana Davidoff of Big Purple Dot: COVID’s Impact on Mortgage Marketing

Roxana Davidoff is founder and CEO of Big Purple Dot, Irvine, Calif., a provider of an ecosystem of mortgage marketing technologies that includes CRM lead management, lead recapture, predictive analysis and video production and texting.

Call for Nominations: MBA NewsLink 2022 Tech All-Star Awards; Deadline Jan. 21

The nomination period for the MBA NewsLink 2022 Tech All-Star Awards is underway with a new, simplified entry form. Nominations will be accepted through Friday, Jan. 21.

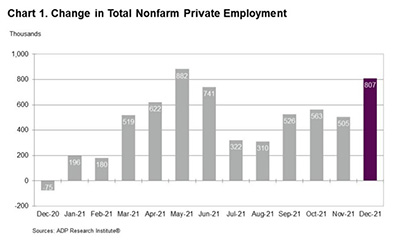

ADP: December Private-Sector Employment Jumps by 807,000

In the second of four key employment reports this week, ADP, Roseland, N.J., reported private-sector employment increased by 807,000 jobs from November to December.

Renting Less Affordable Than Home Ownership in Most U.S. Markets

Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 58 percent of U.S. counties, reported ATTOM, Irvine, Calif.

Dealmaker: Gantry Secures $40M for Phoenix-Region Distribution Center

Gantry, San Francisco, secured $39.6 million in acquisition financing for a single-tenant distribution center in Phoenix’s Southwest industrial submarket.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

Quote

“Higher fees for high-balance conforming loans and second-home loans should provide an opportunity for the GSEs to lower fees on the mission-centric portions of their businesses that primarily serve first-time and low- to moderate-income borrowers. The use of pricing as a tool to manage loan deliveries is more reasonable than previous efforts that featured percent-of-delivery thresholds, and the extended implementation period will protect consumers and lenders from cost increases on loans already in process.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA Weekly Applications Survey Jan. 5, 2022: Mixed Results over Holidays

Mortgage applications showed life ahead of the holidays but faded strongly during the holiday week, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the weeks ending Dec 24 and Dec. 31.