SAN DIEGO—There’s a lot going on with the mortgage industry right now—post-pandemic operations; regulatory changes; housing affordability; diversity, equity and inclusion. What better way to gain perspective on these issues than asking several top-level industry executives what they’re seeing?

Category: News and Trends

Chris Meade of Lender Close: The Right Stuff–How the Right Technology Can Unlock Real Estate and Home Equity Lending

Chris Meade is Vice President of Client Relations of LenderClose, a fintech engaged in providing technology platforms to home equity and real estate lenders. With more than 10 years of experience in the technology industry, he seeks to build and enrich client relationships with a personable and user-centric approach.

mPowering You: Accelerating Gender and Racial Equity

SAN DIEGO—Ishanaa Rambachan, a partner with McKinsey & Co., puts things bluntly: “This is one of the most tumultuous times to be a woman in the workplace.”

Industry Briefs Oct. 21, 2021: Clarifire Partners with Freddie Mac on Streamlined Servicing Workouts

Clarifire, St. Petersburg, Fla., announced its CLARIFIRE workflow automation application has gone live with Resolve, Freddie Mac’s new integrated default management platform.

MBA Education Honors Daniel Jensen with Willis Bryant Award

MBA Education, the award-winning education division of the Mortgage Bankers Association, honored Federal Housing Finance Agency Office of the Inspector General’s Daniel Jensen with its Willis Bryant Award.

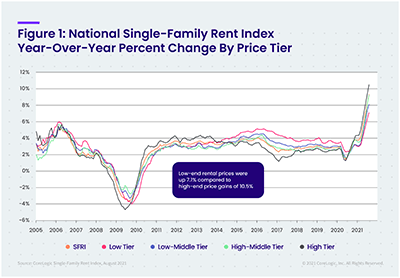

Single-Family Rent Prices Near Double-Digit Growth in August

CoreLogic, Irvine, Calif., reported rents for single-family rental properties increased 9.3 percent year-over-year, up from a 2.2 percent year-over-year increase a year ago.

Dealmaker: Alliant Credit Union Funds Three Student Housing Loans Totaling $51M

Alliant Credit Union, Chicago, closed $51 million in financing for three student housing properties located near Louisiana State University, Baylor University and the University of Tennessee, Knoxville.

MBA Weekly Applications Survey Oct. 20, 2021: Applications Decrease

Mortgage applications decreased 6.3 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 15, 2021.

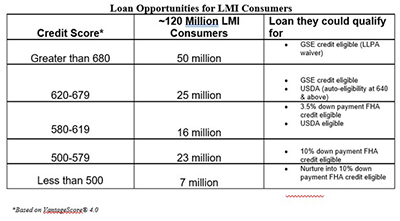

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

mPowering You: Looking Ahead—Knowing Your Value and Asking for What You Want

SAN DIEGO—After 18 months as the country and businesses return to normal, what is the new normal in the workplace?