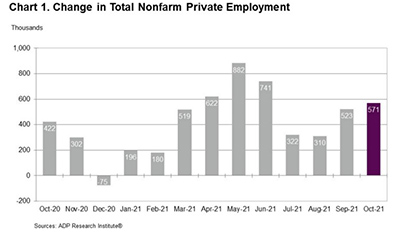

In the first of several major reports this week on U.S. employment, ADP, Roseland, N.J., said private-sector employment increased by 571,000 jobs from September to October.

Category: News and Trends

MBA, Trade Groups Urge Congress to Reject OECD Marginal Rates in Proposed Legislative Framework

As the House and Senate near what appears to be the end of a long and contentious inter- and intraparty debate over an economic stimulus package, the Mortgage Bankers Association joined nearly 100 other trade associations and policy groups to oppose a provision they say would unfairly tax family-owned businesses.

MarCom Awards Recognize Innovative MBA DEI Series

MarCom Awards, Dallas, Texas, announced winners in its 2021 international creative competition for marketing and communication professionals. From more than 6,000 entries, MarCom gave the Mortgage Bankers Association a Gold Award for its innovative Voices: Courageous Conversations with Women of Color virtual series.

Seller Profits Increase Across U.S.

ATTOM, Irvine, Calif., said profit margins on median-priced single-family home and condo sales jumped to 47.6 percent–the highest level since Great Recession ended a decade ago.

Fed Makes Tapering Official; Signals Higher Rates in the Offing

The Federal Open Market Committee—which takes pains to not rock the economic boat—announced yesterday what most analysts already anticipated: that it would begin to taper its asset purchases, while gently signaling a rise in short-term interest rates in the near future.

Dealmaker: Institutional Property Advisors Closes $124M in Multifamily Transactions

Institutional Property Advisors, Ontario, Calif., sold two multifamily properties for separate clients in transactions totaling $123.5 million.

MBA: 3Q Commercial/Multifamily Borrowing Jumps Nearly 120% Year over Year

Commercial and multifamily mortgage loan originations increased by 119 percent in the third quarter from a year ago and increased by 19 percent from the second quarter, the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations reported.

Tom Lamalfa: October 2021 MBA Annual Convention & Expo Survey

In early October I surveyed 34 senior executives from 34 separate mortgage companies about an array of issues and topics both relevant and consequential to the mortgage banking industry. It was the 26th time since 2008 that this survey has been conducted and published by the MBA.

Industry Briefs Nov. 4, 2021: Pretium Acquires Anchor Loans

Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

Quote

“With the job market looking strong, and inflation well above target and likely to stay there for some time, the Federal Reserve moved to begin to taper their asset purchases and signaled that they are beginning to think about raising short-term rates. The timing and amount of tapering are in line with market expectations and as previously communicated by the Fed.”

–MBA Chief Economist Mike Fratantoni.