The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Category: News and Trends

MBA Advocacy Update Nov. 15 2021

On Wednesday, the Consumer Financial Protection Bureau issued a statement in conjunction with other federal and state financial regulators that announced the end of Regulation X mortgage servicing flexibilities that have been in place since April 2020 as a result of the COVID-19 pandemic.

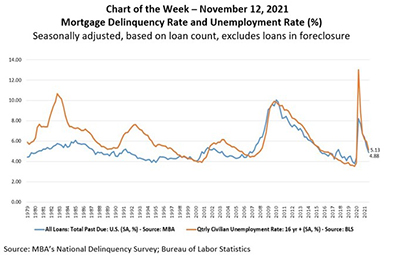

MBA Chart of the Week Nov. 12, 2021: Mortgage Delinquency Rate & Unemployment Rate

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter, according to the Mortgage Bankers Association’s National Delinquency Survey, released last week.

Quote

“The strong monthly gain puts MBA’s estimate of new home sales at its strongest pace since January. Purchase activity continues to be dominated by higher loan balance transactions, which pushed the average new home loan size up to over $412,000, another new record in the survey.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

MBA CONVERGENCE Partner Profile: Stephanie Moulton

The Ohio State University is a key leader in CONVERGENCE Columbus; Dr. Stephanie Moulton is the co-lead of the Evaluation Framework Working Group for CONVERGENCE Columbus.

Faith Schwartz of Housing Finance Strategies: Three Keys to the Future of Appraisal

There can be no debate that bias must be eradicated from the collateral valuation process. While some may question the cause or amount of bias, the fact is we need to eliminate any bias from the system.

Nomi Smith of PMI Rate Pro: How to Build a Stronger Mortgage Business Now

It’s time to make a decision. What will you be doing in 2022? If you’re in the mortgage industry and you think you’ll still be in the business next year, there’s a good chance you’re wrong. The business will shrink next year and many who are working here now won’t be here by the end of the year.

Mark P. Dangelo: Coming to a Store Near YOU, the Low-Code/No-Code Revolution

The time to effectively transform our analysis of all things digital is being reduced from months to days. The revolution and rapid embrace of low-code/no-code solutions by giant Walmart will set off multiple tangential strategies to influence the consumer—all in the hands of newly empowered, front-line domain experts.

Rick Triola of NotaryCam: Worried About RON Storage? Stream It

Both Fannie Mae and Freddie Mac have updated their selling guides to state that lenders must retain the audio-video recording of the RON transaction for the greater of either (a) the minimum period required by the state in which the notary is licensed or (b) 10 years. This guideline has left a lot of lenders wondering just how to store all that audio-video footage…and spurred a new crop of vendors ready to meet this “need.”

Investors Increase Commercial Real Estate Allocations

Despite decreased returns in 2020, institutional investor confidence in commercial real estate remains strong, according to Hodes Weill & Assocs. and Cornell University’s Baker Program in Real Estate.