The Mortgage Bankers Association announced members of its 2022 Affordable Rental Housing Advisory Council. The Advisory Councils on affordable rental housing and affordable homeownership were formed in 2019 to provide important strategic and practical guidance to MBA’s CONVERGENCE Initiative, the association’s affordable housing effort.

Category: News and Trends

Dealmaker: Marcus & Millichap Closes $26M for Fla. Retail, Hotel

Marcus & Millichap, Calabasas, Calif., closed $26.3 million in Florida retail and hotel transactions.

MBA Offices Closed Nov. 25/26

Mortgage Bankers Association offices will be closed on Thursday, Nov. 25 and Friday, Nov. 26 in observance of the Thanksgiving holidays.

KBRA: Pandemic Shutdown Bifurcates Commercial Real Estate Market

Pandemic-related shutdowns and restrictions bifurcated the commercial real estate market based on its demand generators, reported Kroll Bond Rating Agency, New York.

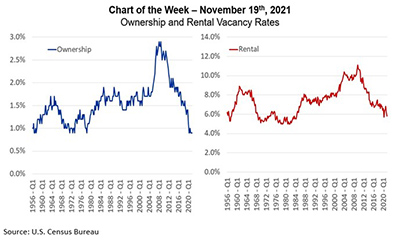

MBA Chart of the Week: Ownership & Rental Vacancy Rates

The U.S. housing stock is full.

MBA Advocacy Update Nov. 22, 2021

On Friday, the House passed the most current version of President Biden’s Build Back Better Act legislation, largely along party lines. On Monday, HUD published its Annual Report to Congress on the financial status of the FHA’s MMI Fund. And on Wednesday, HUD released Mortgagee Letter 2021-27, which provides details regarding Fair Housing Act compliance with respect to FHA appraisals.

Quote

“Housing demand continues to be held back by insufficient supply. It was positive news that home sales increased for the second month in a row and at the fastest pace of sales since January. Similar to MBA’s recent weekly data on purchase mortgage applications, home sales are still running below last year’s elevated pace but have shown some renewed strength recently.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Housing Market Roundup Nov. 23, 2021

Here’s a summary of some of the latest housing and economic reports that have come across the MBA NewsLink desk:

Keeping Current With Midland Loan Services’ David Harrison

David Harrison is Chief Operating Officer with Midland Loan Services, Overland Park, Kan. He has a broad background in commercial real estate, including capital markets, asset management, underwriting, workouts, business development and client relations.

To the Point with Bob: Servicers are Helping Borrowers Through the Pandemic

Policymakers have gone to great lengths to provide servicers and borrowers the tools they need to bring about a successful resolution in the vast majority of cases. I hope that policymakers will continue to allow servicers to do what they do best – help their customers.