Lument, New York, provided $55 million in bridge loans for multifamily communities in Texas and Tennessee.

Category: News and Trends

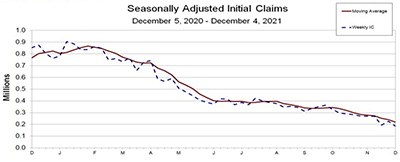

Initial Claims Fall to 52-Year Low

After an uptick the previous week, initial claims for unemployment insurance resumed their sharp downward trajectory, falling to their lowest level in more than 52 years.

Industry Briefs Dec. 10, 2021: Beeline Completes Series A Funding

Beeline, Providence, R.I., a digital start-up mortgage lender, completed a Series A round of financing for an undisclosed amount. The capital will be invested in automation and artificial intelligence to improve the user experience for borrowers.

Sharon Reichhardt of ACES Quality Management: For a Successful 2022, The Season of Giving Must Include an Enhanced QC/QA Process

With regulators also tightening their expectations and requirements around compliance, there is no time better than the present for lenders to get ahead and shore up their quality control and quality assurance efforts to ensure a successful 2022.

MBA Independent Mortgage Bankers Conference in Nashville Jan. 24-27

The Mortgage Bankers Association’s Independent Mortgage Bankers Conference 2022 takes place Jan. 24-27 in Nashville, Tenn.

Quote

“As home-price growth continues, and mortgage rates creep higher, increased credit availability is needed for qualified borrowers looking to purchase a home – especially for first-time homebuyers, who rely heavily on government mortgage programs.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Parvesh Sahi of ICE Mortgage Technology on Digitizing Correspondent Lending

Parvesh Sahi is Senior Vice President of Business and Client Development with ICE Mortgage Technology, Pleasanton, Calif.

People in the News Dec. 10, 2021: LoanLogics Names Quinn Thomas Chief Revenue Officer

LoanLogics, Jacksonville, Fla., named Quinn Thomas chief revenue officer. He will be responsible for establishing and developing ongoing relationships with LoanLogics’ largest enterprise clients as well as leading the company’s sales, marketing, account management and audit operations.

MISMO Standardizes Property Financial Statement Data Exchange

MISMO®, the real estate finance industry standards organization, seeks public comment on a proposed standard to facilitate a more accurate and efficient exchange of commercial financial operating statement data.

Andrew Peters of Lenderworks: Rethinking Growth Strategy for Smaller Lenders in an Era of Margin Compression

Smaller lenders have options to stay competitive in spite of increased costs.