Commercial and multifamily real estate – after years of strong and steady growth – is in a period of transition, driven by changes in the space, equity and debt markets.

Tag: Reggie Booker

MBA Launches Commercial Real Estate Finance Student Fellowship Program

The Mortgage Bankers Association launched a new fellowship program for students from underrepresented groups interested in learning more about internships, jobs and careers in the $4 trillion commercial real estate finance industry.

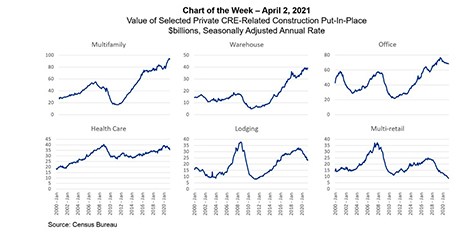

Chart of the Week: Value of CRE Construction

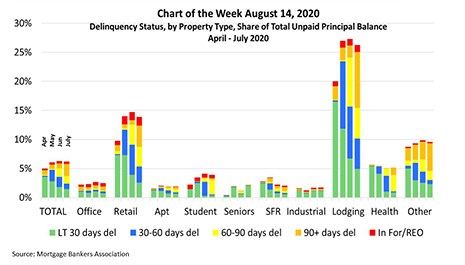

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

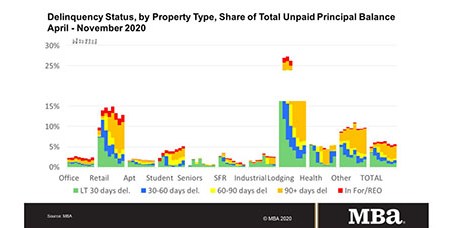

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.

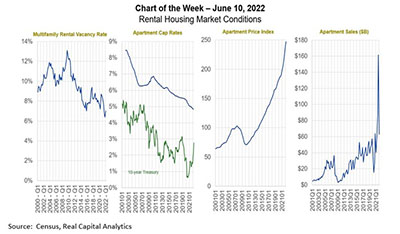

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

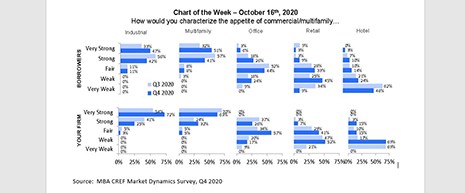

MBA Chart of the Week: Appetite for Commercial and Multifamily

One of the most striking aspects of the pandemic’s impact on commercial real estate markets is the markedly disparate impact it is having on different property types.

Today: CREF Careers Virtual Job Fair

Commercial Real Estate Finance Careers (CREF Careers) Virtual Job Fair begins today, Oct. 22, 2020, at 3:00 PM ET.

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans (2.8%) and slightly more than half of the balance of loans that had been less than 30-days delinquent in April moving to the 30-60 days delinquent category. The inflow of newly delinquent loans continued to slow in June (1.8% of overall balances) and July (1.4%).

MBA Chart of the Week: Year-to-Date Returns for REIT Stocks

How the health, social and economic impacts of the coronavirus outbreak flow through to commercial and multifamily properties remains clouded in uncertainty – mainly because of the uncertainty about the virus itself and our public and private responses to it. One thing that is clear is that different property types and different markets will be affected differently.