MBA Chart of the Week: Rental Housing Market Conditions

Commercial and multifamily real estate – after years of strong and steady growth – is in a period of transition, driven by changes in the space, equity and debt markets.

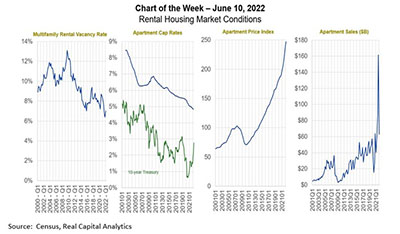

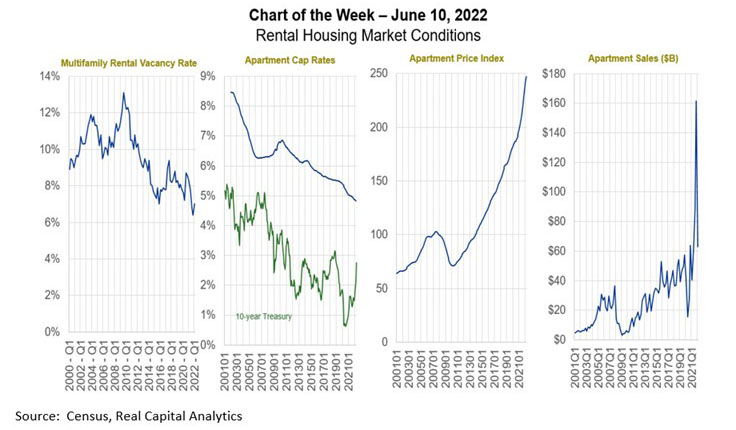

In terms of space markets, each property type is in a different place. According to the U.S. Census Bureau, vacancy rates for multifamily rental properties increased slightly in the first quarter, but, at a collective 7.0 percent, remain at levels not seen since the mid-1980s. Industrial demand has similarly been extremely strong, although recent news that Amazon feels they now have too much space has raised some questions for what has been a Teflon market.

Even while business travel has not yet fully returned, hotel occupancy has (+3 percent from pre-pandemic levels), with Revenue Per Available Room (RevPAR) now 26 percent higher than at comparable periods in 2019. Given all that, office has now claimed the title of “greatest uncertainty” as businesses continue to adjust and refine their plans for in-office, hybrid and remote work. Kastle systems is reporting that office occupancy is still in the low-40 percent range.

Across all of the above, different sub-property types and geographic markets – and submarkets – are experiencing very different conditions.

Equity markets have also been transitioning – partly in response to changing expectations for space and debt markets, and also because of a change in equity investment conditions themselves. After averaging 35,848 in November 2021, the Dow Jones Industrial Average was 32,379 in May, a 10 percent drop, as investors re-assessed economic conditions and the high valuations of many companies. The S&P 500 P/E (operating earnings) ratio fell from 22 to 19, a drop of 12 percent. It’s too early to see in the data if those valuation changes were mirrored (or shadowed) in the commercial and multifamily real estate markets, but capitalization rates started the year at the lowest levels on record.

Low Treasury yields meant cap rate spreads were relatively robust, but with base rates essentially doubling in the first quarter, those spreads have been cut almost in half. Spreads remain well wide of 2007 levels, roughly matching what was seen in 2018.

–Jamie Woodwell jwoodwell@mba.org.