Boxwood Means LLC, Stamford, Conn., said weaker economic conditions on Main Street are impeding small-cap commercial real estate.

Tag: Randy Fuchs

CMF Quote of the Week: May 11, 2023

“Uncertainty and volatility in regard to interest rates and property values, and supply and demand imbalances for some property types, has led to a logjam in commercial real estate sales and financing markets.”

–Jamie Woodwell, MBA Head of Commercial Real Estate Research.

The Sky Isn’t Falling for Small-Cap Commercial Real Estate

Small-cap commercial real estate appears to be in better shape than the larger CRE market, reported Boxwood Means LLC, Stamford, Conn.

Quote

“A continuing slowdown in across-the-board leasing velocity reflects mounting concerns among small businesses that economic conditions will get worse before they get better. The Federal Reserve appears hellbent on taming the inflation tiger, and the current regime of interest rate hikes has taken the air out of the proverbial balloon, has raised market risks and may level potentially punishing effects on all commercial real estate market participants.”

–Boxwood Means Principal and Co-Founder Randy Fuchs.

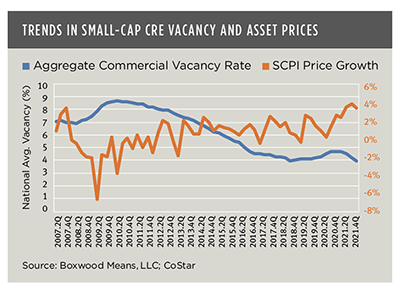

Small-Cap CRE Prices ‘Rationally Tracking’ Fundamentals

Small-cap commercial real estate prices have accelerated at an unprecedented rate but are not overinflated, reported Boxwood Means LLC, Stamford, Conn.

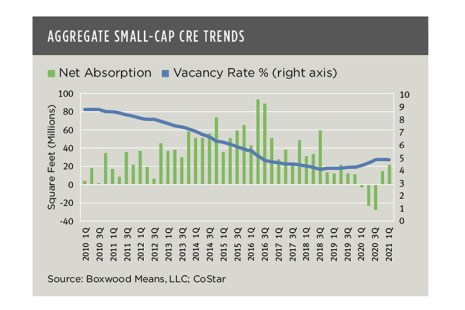

Small-Cap Commercial Real Estate Firing on All Cylinders

The economic rebound has boosted small businesses, giving small-cap commercial real estate leasing and investment markets a jolt, reported Boxwood Means LLC, Stamford, Conn.

Quote

“Stellar small-cap retail sector performance, which flies in the face of public debate ad nauseum about the existential threat to retail posed by online shopping, conjures up Rodney Dangerfield’s famous line about getting no respect,”

–Randy Fuchs, Principal and Co-Founder with Boxwood Means LLC, Stamford, Conn.

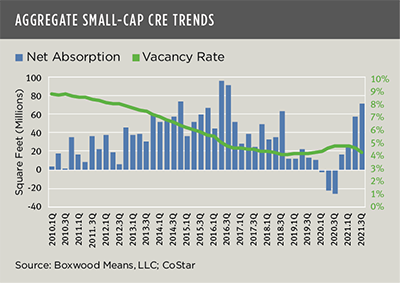

Small-Cap CRE Bounces Back

Boxwood Means LLC, Stamford, Conn., said small-cap commercial real estate is coming back into balance with larger properties after pandemic-induced shocks to the U.S. economy and the CRE markets.

Small Cap Industrial, Retail Leasing Takes Off

Boxwood Means LLC, Stamford, Conn., said leasing in the small-cap real estate domain showed strong momentum during the first quarter as the economy bounced back from the pandemic.

Small-Cap Multifamily ‘Resilient’

Small-cap multifamily properties are proving resilient during the pandemic-induced recession, said Boxwood Means, Stamford, Conn.