Small-Cap CRE Prices ‘Rationally Tracking’ Fundamentals

Small-cap commercial real estate prices have accelerated at an unprecedented rate but are not overinflated, reported Boxwood Means LLC, Stamford, Conn.

Boxwood Means Principal and Co-Founder Randy Fuchs noted the rising inflation in small-cap CRE asset values naturally raises the question of whether the market is getting overheated. “As far as the small-cap commercial real estate market is concerned, the answer appears to be no,” he said.

Fuchs said in overexuberant markets, prices rise rapidly, investors grow extremely bullish and–importantly–assets are traded with little consideration of the financials or property fundamentals. “This market exuberance often leads to speculative purchasing behavior that only pushes prices higher,” he said. “There is no question that small-cap commercial real estate property prices have rocketed.”

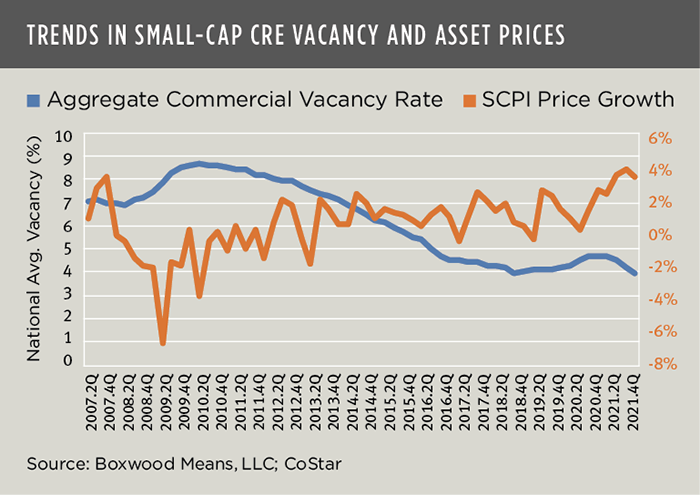

The Boxwood National Small Commercial Price Index posted double-digit annual price growth for eight consecutive months as of January, an unprecedented streak in our historical time series dating to 2006. The 19.2 percent asset price appreciation since the short COVID recession began in February 2020 represents the highest two-year jump in prices Boxwood Means has recorded, Fuchs said.

“Yet what may be equally if not more determinative are the facts and signals emanating from the commercial real estate space market,” Fuchs said. “In this regard, a key question to address is to what degree have these frothy prices tracked or, on the other hand, fallen out of sync with property fundamentals.” He noted an inverse relationship between quarterly changes in Small Commercial Price Index prices and the aggregate national small-cap vacancy rate across small office, industrial and retail sectors. A strong -.53 correlation between these two variables indicates asset prices increased as vacancy rates edged down. In fact, the national small-cap vacancy rate declined by a sizable 70 basis points last year as commercial real estate leasing demand spiked in concert with the revitalization of small businesses and a strong rebound in the national economy.

“It makes some sense that knowledgeable investors might rationally bid up asset prices considering that tight space market conditions naturally bolster rent and net operating income growth,” Fuchs said. “But what makes this argument even more compelling is the long-standing structural gap between small-cap commercial real estate supply and demand since the end of the Great Recession. Indeed, demand soared with the ensuing economic recovery but the supply spigot never turned up in response.”

This delta between small-cap commercial real estate demand and inventory expansion, coupled with a relatively quiet new construction pipeline, shapes up as a “classic case of market disequilibrium,” Fuchs said.

“Given the strong property and capital market fundamentals, it’s not surprising then that investors have rushed into the arena to acquire small-cap commercial real estate assets,” Fuchs said. “But in sum, the record runup in prices is not caused by blatant disregard for suitable asset values, nor is it speculative buying untethered from market reality. In fact, these small-cap commercial real estate market trends appear to be telling us the opposite: prices are rationally tracking fundamentals.”