The Research Institute for Housing America, MBA’s think tank, released updated first-quarter results that allow us to assess how renters, mortgagors and student loan borrowers fared over the first 12 months of the COVID-19 pandemic.

Tag: MBA Chart of the Week

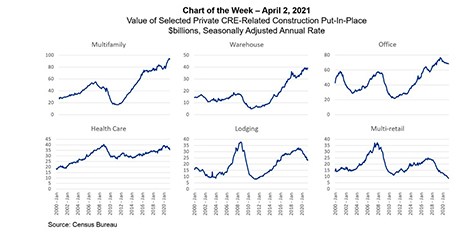

Chart of the Week: Value of CRE Construction

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

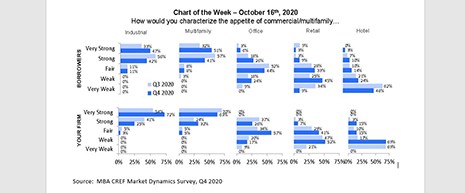

MBA Chart of the Week: Appetite for Commercial and Multifamily

One of the most striking aspects of the pandemic’s impact on commercial real estate markets is the markedly disparate impact it is having on different property types.

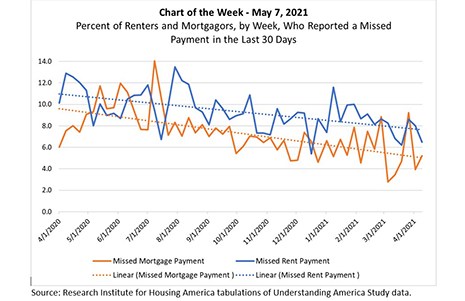

MBA Chart of the Week: Rent Payments and COVID-19

On September 17, the Research Institute for Housing America, MBA’s think tank, released a special report on housing-related financial distress during the second quarter – the first three months of the pandemic in the U.S.

MBA Chart of the Week: Retail E-Commerce/Retail Sales

When real estate professionals discuss the impacts of the COVID-19 pandemic

on commercial real estate, their comments generally come in one of four themes.

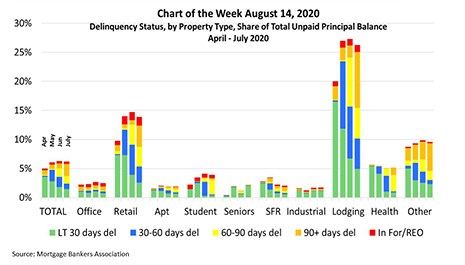

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans (2.8%) and slightly more than half of the balance of loans that had been less than 30-days delinquent in April moving to the 30-60 days delinquent category. The inflow of newly delinquent loans continued to slow in June (1.8% of overall balances) and July (1.4%).

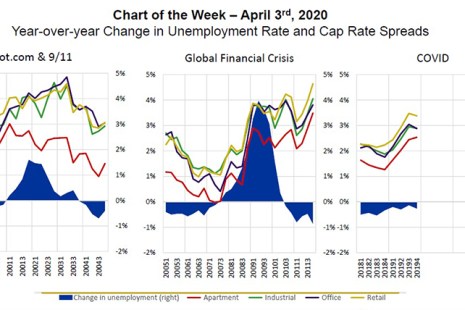

MBA Chart of the Week: Year-over-Year Change in Unemployment Rate and Cap Rate Spreads

For commercial real estate markets, a key factor in how we work through this period of uncertainty will be how investors value properties and their incomes. Our experiences in the past two recessions may provide some insights.