Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.

Tag: KBRA

Economic Uncertainty, Remote Work Challenge Office Sector

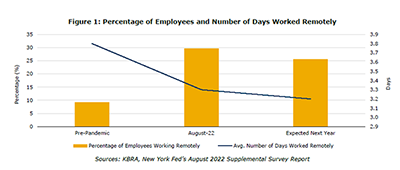

Despite five interest rate increases in 2022, inflation remains near multi-year highs. This could hit the office sector harder than other property types, said KBRA, New York.

Economic Uncertainty, Remote Work Challenge Office Sector

Despite five interest rate increases in 2022, inflation remains near multi-year highs. This could hit the office sector harder than other property types, said KBRA, New York.

A Decade in the Making: KBRA on SFR Trends and Outlook

KBRA, New York, recently published a report, SFR Securitizations: A Decade in the Making, analyzing the sector’s evolution and growth. MBA Newslink interviewed the report’s authors about the factors driving the sector’s growth.

KBRA: Servicers Performed Admirably During COVID

Kroll Bond Rating Agency, New York, said commercial mortgage-backed securities servicers “performed admirably” over the last two years while facing nearly unprecedented distress during the COVID pandemic.

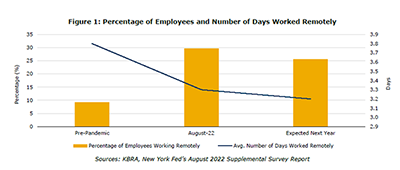

CMBS Delinquency Rate, Liquidations Drop

The commercial mortgage-backed securities delinquency rate continues to decline, and CMBS liquidations also dropped last year, analysts said.

Fitch: Slowing Trend in CMBS Defeasance

Commercial mortgage-backed securities defeasance volume soared during late 2021 and into January, but that trend could be ending, said Fitch Ratings, New York.

CMBS Defeasance Snaps Back

Kroll Bond Rating Agency, New York, reported commercial mortgage-backed securities defeasance volume rebounded strongly last year after falling by nearly half in 2020.

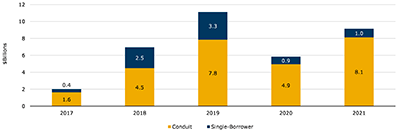

CMBS Delinquency, Special Servicing Rates Dip in December

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

CMF Briefs from KBRA, Parthenon Capital, TruAmerica Multifamily

KBRA, New York, entered a deal with private equity firm Parthenon Capital Partners, Boston, which will acquire a majority stake in the company.