MBA NewsLink recently interviewed Kroll Bond Rating Agency’s Larry Kay and Aryansh Agrawal about their 2026 commercial mortgage-backed securities outlook.

Tag: KBRA

KBRA: Self-Storage Outperforms Despite Headwinds

Kroll Bond Rating Agency, New York, reported the self-storage sector has been one of the best-performing property types in commercial mortgage-backed securities, even while facing headwinds in the last two years.

MBA NewsLink Multifamily Roundtable: On Rents, Ratings and Refinancings

MBA NewsLink recently interviewed three executives about shifting dynamics in multifamily finance, investment and credit ratings.

Commercial and Multifamily People in the News, Sept. 18, 2025

Commercial and multifamily industry personnel news from CBRE, KBRA, Pace Loan Group and JLL.

KBRA Says CMBS 2.0 Office Exposure Rising

Kroll Bond Rating Agency, New York, reported the five-year trend of conduit office exposure declining reversed in first quarter, with exposure rising to 16.3% from 13.9% in Q1 2024 and 15.4% for the full-year 2024.

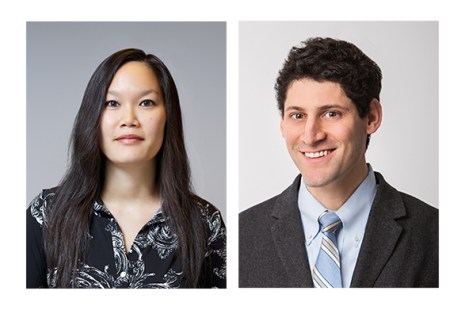

CRE CLO Resurgence: A Conversation with Christina Moy & Margit Grejdus from KBRA

MBA Newslink recently interviewed Kroll Bond Rating Agency’s Christina Moy and Margit Greydus about commercial real estate collateralized loan obligations (CRE CLO) credit from their vantage points handling new issuance and surveillance credit ratings.

KBRA Says CMBS Ended 2024 on High Note

KBRA, New York, reported commercial mortgage-backed securities ended the year on a high note, as issuance exceeded $100 billion in 2024—a level experienced only once since the global financial crisis.

MBA NewsLink Roundtable: The Top CMBS Issues to Watch in 2025

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives for their perspective on the industry landscape in the new year. They cover CMBS issuance, credit ratings, loan originations, loan delinquencies and loan defaults.

NewsLink Q&A: KBRA’s 2025 CMBS Outlook: Twin Peaks?

Kroll Bond Rating Agency just released its CMBS 2025 Sector Outlook, which forecasts issuance activity for the new year. MBA NewsLink interviewed two KBRA analysts about the current lending environment as well as factors that may affect property performance in 2025.

Commercial and Multifamily People in the News Oct. 24, 2024

Industry personnel news in the commercial and multifamily sector from KBRA and CBRE.