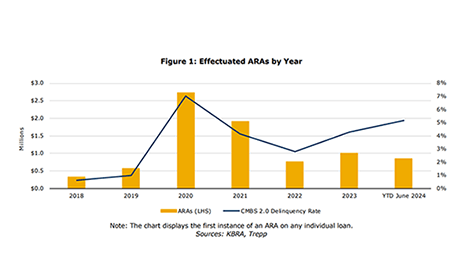

Kroll Bond Rating Agency, New York, reported that commercial mortgage-backed securities appraisal reduction amounts–ARAs–have climbed in tandem with delinquency rates.

Tag: KBRA

Commercial and Multifamily People in the News Aug. 29, 2024

Commercial and multifamily personnel news from KBRA, Affinius Capital and Walker & Dunlop.

CMBS Delinquency Rate Increases Moderately

The delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased moderately in April to 4.67%, according to KBRA, New York.

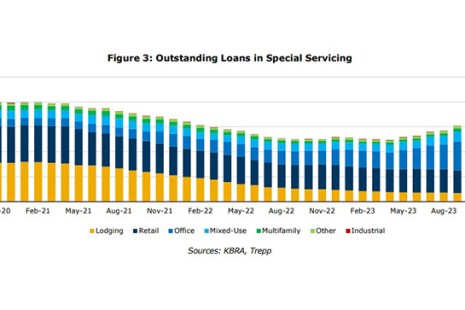

MBA NewsLink Roundtable: Top Commercial Mortgage Servicing Issues to Watch in 2024

Commercial and multifamily mortgage loan originations were 49% lower in the third quarter of 2023 compared to a year ago and decreased 7% from the second quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. While a full-year 2023 view will not be available for a little while, it was a down year.

KBRA: CMBS Delinquency Rate Ticks Upward

KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.

CMBS Delinquency Rate Dips, KBRA Reports

The delinquency rate among KBRA-rated commercial mortgage-backed securities dipped four basis points in October to 4.21%, the rating agency reported.

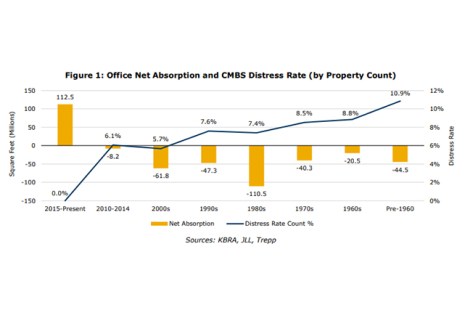

KBRA: Older Office Buildings Struggling

KBRA, New York, said in the current office environment, older buildings are seeing particular challenges.

KBRA: Securitized Multifamily and the Housing Affordability Gap

Since 2020, greater apartment rent increases occurred in markets with higher homeownership costs as lower affordability drove up demand for rental units, reported KBRA, New York.

KBRA: Challenging Single-Family Rental Fundamentals

Softening operating performance, elevated inflation, labor shortages and decelerating rental rates have produced the most challenging environment for the single-family rental sector yet, reported KBRA, New York.

KBRA: Lodging Loan Performance Clouded by Upper-Upscale Chains

U.S. hotels have performed well overall since the pandemic, but upscale properties report higher commercial mortgage-backed securities delinquencies than more modest hotels, reported KBRA, New York.