SAN DIEGO — The Mortgage Bankers Association said $248.8 billion of the $2.6 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2022, a 12 percent increase from the $222.5 billion that matured in 2021.

Tag: Jamie Woodwell

MBA: 4Q Commercial, Multifamily Mortgage Delinquencies Decline

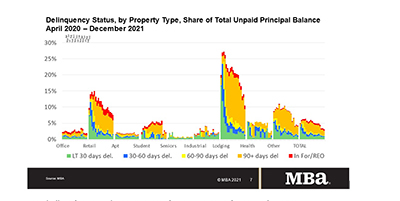

Delinquency rates for mortgages backed by commercial and multifamily properties declined in the final three months of 2021, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

MBA CREF Outlook Survey: Originators Bullish on 2022 Outlook

Commercial and multifamily mortgage originators anticipate 2022 will be another strong year of borrowing and lending, according to the Mortgage Bankers Association’s 2022 Commercial Real Estate Finance Outlook Survey.

Quote

“Commercial and multifamily mortgage professionals are bullish on 2022. After a strong market bounce-back in 2021, top mortgage bankers expect the momentum to continue in 2022 – with borrowing and lending increasing for every major capital source.” –Jamie Woodwell, MBA Vice President Commercial Real Estate Research

Quote

“[Multifamily] property fundamentals are remarkable, as is investor sentiment. That interest has brought a strong pipeline of new development, but for the time being even that is having trouble keeping up with demand.”

–Jamie Woodwell, Vice President of Commercial Real Estate Research with the Mortgage Bankers Association.

MBA: 3Q Holdings of Commercial/Multifamily Mortgage Debt Increase

Commercial/multifamily mortgage debt outstanding increased by $64.8 billion (1.6 percent) in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

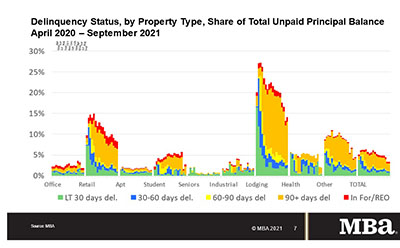

MBA: 3Q Commercial/Multifamily Mortgage Delinquency Rates Decrease

Commercial and multifamily mortgage delinquencies declined in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

MBA: 3Q Commercial/Multifamily Borrowing Jumps Nearly 120% Year over Year

Commercial and multifamily mortgage loan originations increased by 119 percent in the third quarter from a year ago and increased by 19 percent from the second quarter, the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations reported.

MBA: September Commercial, Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

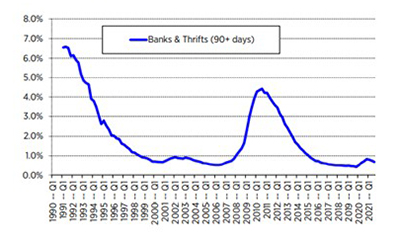

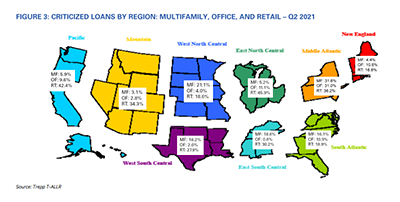

Trepp: Bank Commercial Real Estate Loan Performance ‘Not Bad, But Maybe Not That Great’

Trepp, New York, said delinquency rates for commercial real estate loans held by banks are declining after increasing modestly last year.