The Mortgage Bankers Association this week issued a white paper examining how climate change is dramatically reshaping lenders’ and policymakers’ approaches to the U.S. real estate market.

Tag: Jamie Woodwell

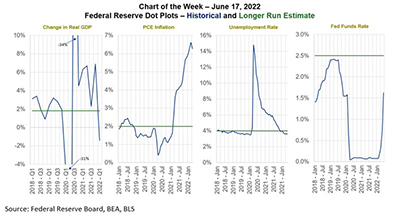

MBA Chart of the Week: Federal Reserve Projections

The Federal Reserve is racing to catch up to economic events, announcing a 75-basis-point increase in the federal funds rate and signaling more increases following last week’s FOMC meeting.

MBA: Record-High 1Q Commercial/Multifamily Mortgage Debt Outstanding

Commercial/multifamily mortgage debt outstanding increased by $74.2 billion (1.8 percent) to record levels in the first quarter, the Mortgage Bankers Association reported Thursday in its quarterly Commercial/Multifamily Mortgage Debt Outstanding Report.

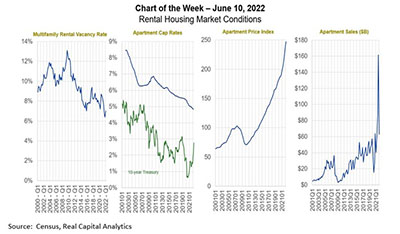

MBA Chart of the Week: Rental Housing Market Conditions

Commercial and multifamily real estate – after years of strong and steady growth – is in a period of transition, driven by changes in the space, equity and debt markets.

MBA Launches Commercial Real Estate Finance Student Fellowship Program

The Mortgage Bankers Association launched a new fellowship program for students from underrepresented groups interested in learning more about internships, jobs and careers in the $4 trillion commercial real estate finance industry.

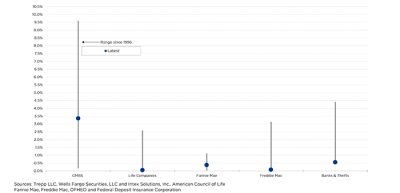

MBA: 1Q Commercial, Multifamily Mortgage Delinquency Rates Drop

Commercial and multifamily mortgage delinquencies declined in the first quarter, the Mortgage Bankers Association reported in its Commercial/Multifamily Delinquency Report.

MBA: 1Q Commercial/Multifamily Borrowing Jumps 72% from Year Ago

Commercial and multifamily mortgage loan originations increased by 72 percent in the first quarter from a year ago, the Mortgage Bankers Association reported Thursday.

Healthy Forecast for Commercial Real Estate

Commercial real estate can anticipate post-pandemic growth rooted in strong regional markets and steady commercial and multifamily lending, the Urban Land Institute said.

MBA Forecast: Commercial/Multifamily Lending Holds Steady Amid Higher Rates, Economic Uncertainty

Total commercial and multifamily mortgage borrowing and lending is expected to hold steady at a projected $895 billion in 2022, roughly in line with 2021 totals ($891 billion), the Mortgage Bankers Association said Monday.

MBA: Commercial, Multifamily Mortgage Bankers Originated $683B in 2021; Total Lending Tally Reaches $891B

Commercial and multifamily mortgage bankers closed $683.2 billion of loans in 2021, the Mortgage Bankers Association reported Thursday. MBA estimated total CRE lending including activity from smaller and mid-sized depositories totaled $890.6 billion.