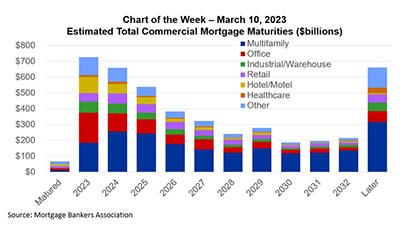

At MBA’s CREF Convention in San Diego last month, we released the results of our annual survey of upcoming commercial and multifamily mortgage maturities. The survey collects information directly from loan servicers on when the loans they service mature.

Tag: Jamie Woodwell

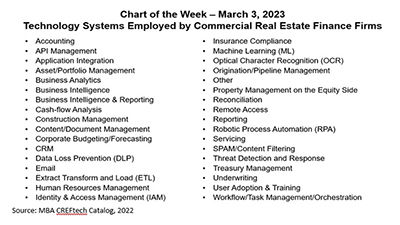

MBA Chart of the Week: Tech Systems Employed by Commercial Real Estate Finance Firms

Lenders closed $800 billion in mortgages backed by income-producing commercial and multifamily properties in 2022–adding to what is now almost $4.4 trillion in outstanding loans.

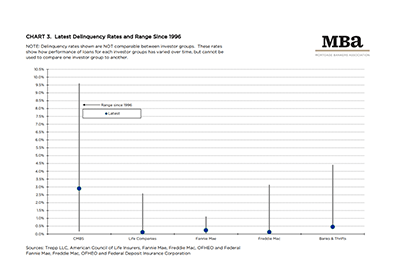

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rate Remains Low

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

#MBACREF23: 2023 Commercial/Multifamily Borrowing, Lending Expected to Fall to $684B

SAN DIEGO–The Mortgage Bankers Association said total commercial and multifamily mortgage borrowing and lending is expected to fall to $684 billion this year, a 15 percent decline from an expected 2022 total of $804 billion.

#MBACREF23: 2023 Commercial/Multifamily Mortgage Maturity Volumes Up 33 Percent

SAN DIEGO–The Mortgage Bankers Association said $331.2 billion of the $2.8 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2023, a 33 percent increase from the $249 billion that matured in 2022.

#MBACREF23: 4Q Commercial/Multifamily Borrowing Down 54%

SAN DIEGO–Commercial and multifamily mortgage loan originations were 54 percent lower in the fourth quarter from a year ago and decreased by 23 percent from the third quarter, the Mortgage Bankers Association reported Monday.

#MBACREF23: 2023 Commercial/Multifamily Borrowing, Lending Expected to Fall to $684B

SAN DIEGO – The Mortgage Bankers Association said total commercial and multifamily mortgage borrowing and lending is expected to fall to $684 billion this year, a 15 percent decline from an expected 2022 total of $804 billion.

#MBACREF23: 2023 Commercial/Multifamily Mortgage Maturity Volumes Up 33 Percent

SAN DIEGO – The Mortgage Bankers Association said $331.2 billion of the $2.8 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2023, a 33 percent increase from the $249 billion that matured in 2022.

#MBACREF23: 4Q Commercial/Multifamily Borrowing Down 54%

SAN DIEGO–Commercial and multifamily mortgage loan originations were 54 percent lower in the fourth quarter from a year ago and decreased by 23 percent from the third quarter, the Mortgage Bankers Association reported Monday.

Largest Negative Returns for Institutional Real Estate Since Great Recession

The National Council of Real Estate Investment Fiduciaries reported institutional-quality commercial real estate returned -3.50% for the fourth quarter, the first negative return since the 2020 COVID pandemic and the largest since the Great Recession.