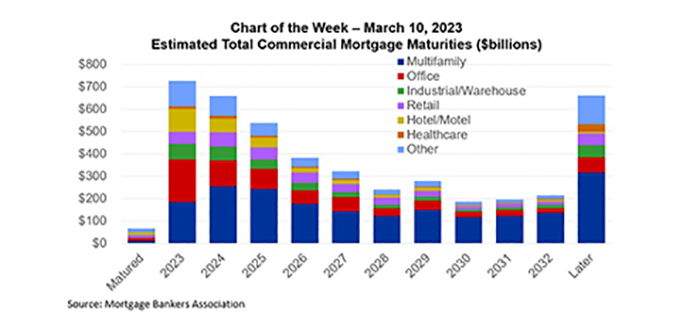

MBA Chart of the Week March 13 2023–Estimated Total Commercial Mortgage Maturities

At MBA’s CREF Convention in San Diego last month, we released results of our annual survey of upcoming commercial and multifamily mortgage maturities. The survey collects information directly from loan servicers on when the loans they service mature.

As in past years, the numbers we released covered loans held by non-bank lenders–including those guaranteed by Fannie Mae, Freddie Mac and FHA, as well as those held by life companies, included in commercial mortgage-backed securities, made by investor-driven lenders like debt-funds, mortgage REITs, and other credit companies.

While the information we collect covers essentially all the loans in those groups, it has typically covered only a sample of loans held by banks.

This year’s survey, however, collected information on $400 billion of bank-held commercial and multifamily mortgages–23 percent of the outstanding universe. Using this year’s survey results, for the first time we are expanding our loan maturity analysis to include an estimate of the maturity profile of all commercial and multifamily mortgages–including the more than $1.7 trillion on bank balance sheets.

The analysis estimates that of $4.4 trillion of outstanding commercial/multifamily mortgages, $728 billion (16%) matures in 2023 with another $659 billion (15%) maturing in 2024. Hotels/motels see the largest share maturing in 2023 (34%) followed by office (25%). Multifamily is the property type with the smallest share of outstanding mortgage maturing this year, (9%).

Among capital sources, 26 percent of the outstanding balance of loans held by credit companies and other investor-driven lenders will mature this year, as will 23 percent of the balances held by depositories and 22 percent held in CMBS. Only 7 percent of life company loans and 2 percent of GSE/FHA loans come due this year.

Tables reporting upcoming annual maturities by property type and capital source have been added to our commercial/multifamily mortgage maturity report.

–Jamie Woodwell jwoodwell@mba.org