Green Street, Newport Beach, Calif., added U.S. Sales Comps to its web-based intelligence and analytics platform. Green Street’s U.S. Sales Comps provides accurate and comprehensive coverage of transactions valued at $5 million and up, plus proprietary macro, sector and market analytics.

Tag: Freddie Mac

FHFA Issues Proposed Rulemaking to Amend GSE Regulatory Capital Framework

It’s been a busy week for the Federal Housing Finance Agency. On Tuesday, FHFA and the Treasury Department suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac. On Wednesday, FHFA announced a notice of proposed rulemaking to amend the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

FHFA, Treasury Suspend Portions of GSE 2021 Preferred Stock Purchase Agreements

The Federal Housing Finance Agency and the Treasury Department on Tuesday suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac in January.

Commercial/Multifamily Briefs Sept. 16, 2021

Freddie Mac, McLean, Va., priced a new offering of Structured Pass-Through K Certificates backed by underlying collateral consisting of fixed-rate multifamily mortgages with predominantly 10-year terms.

Administration Announces Steps to Increase Affordable Housing Supply

The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

FHFA Proposes 2022-2024 Multifamily Housing Goals for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency on Wednesday published its 2022-2024 Enterprise Housing Goals Proposed Rule, which includes raising Fannie Mae and Freddie Mac’s multifamily housing goals from 315,000 to 415,000 low-income units.

Commercial/Multifamily Briefs from JLL, Freddie Mac

JLL, Chicago, agreed to acquire Skyline AI, a leading artificial intelligence technology company that uses proprietary machine learning models to gain a competitive advantage in originating and analyzing commercial real estate opportunities.

Commercial/Multifamily Briefs from Freddie Mac, Brookfield Asset Management

Freddie Mac, McLean, Va., priced a new offering of Multifamily Structured Credit Risk notes, Series 2021-MN2.

Commercial/Multifamily Briefs From Colliers, Freddie Mac, Fannie Mae

Colliers announced a partnership with Blue Skyre IBE LLC to grow its facilities management advisory offering.

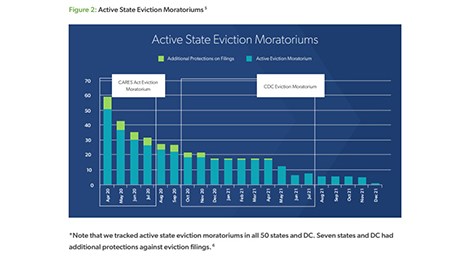

Freddie Mac: Moratoria Staved Off Eviction Crisis During Pandemic

Freddie Mac, McLean Va., said federal and local moratoria in response to the COVID-19 pandemic largely prevented an eviction crisis involving property renters—but the amount of back rent still owed is a “concerning factor” going forward.