FHFA Proposes 2022-2024 Multifamily Housing Goals for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency on Wednesday published its 2022-2024 Enterprise Housing Goals Proposed Rule, which includes raising Fannie Mae and Freddie Mac’s multifamily housing goals from 315,000 to 415,000 low-income units.

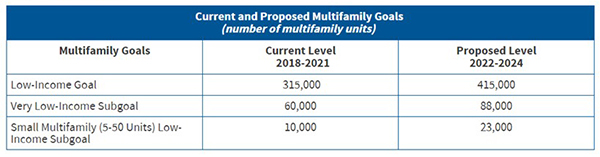

An overview of the multifamily housing goals included in the proposed rule:

The new multifamily housing goals are a part of the broader push by the FHFA to increase the affordable housing purchase goals for single-family and multifamily housing during the 2022-2024 period.

To meet a multifamily housing goal or subgoal, an Enterprise must purchase mortgages on multifamily properties (with five or more units) with rental units affordable to families in each category. FHFA measures Enterprise multifamily goals performance against benchmark levels set in advance. The proposed rule would raise these benchmarks for the 2022-2024 period.

As part of the 415,000 multifamily unit purchasing requirement, the FHFA is requiring each Enterprise to purchase 88,000 units considered “very low income” and 23,000 considered “small multifamily (5-50 units) low-income.” These are increases of 18,000 and 13,000, respectively, compared to the 2018-2021 period.

MBA is analyzing impacts and implications of the proposed rule. Comments will be due 60 days after publication of the proposed rule in the Federal Register.