Freddie Mac, McLean, Va., said the multifamily market will likely continue to cool off this year.

Tag: Freddie Mac Multifamily

Freddie Mac: Apartment Investment Market Index Further Declines

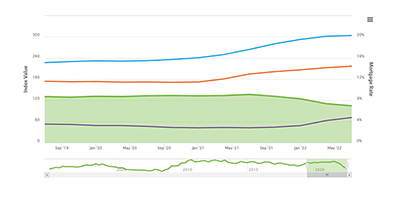

The Freddie Mac Multifamily Apartment Investment Market Index declined 5.4% in the third quarter. The index is down 23.5% year over year.

Commercial/Multifamily News Briefs Nov. 10, 2022

News in brief from HUD, Strawberry Fields REIT, Aeon Investments.

Commercial/Multifamily News Briefs Oct. 20, 2022

News in brief from Freddie Mac Multifamily, Eastdil Secured, Project Destined and Enterprise Community Partners

Freddie Mac Apartment Investment Index Falls

Freddie Mac, McLean, Va., said multifamily market investment conditions continued their deterioration in the second quarter as price appreciation and rising mortgage rates more than offset net operating income growth.

CRE People in the News Sept. 1 2022

Personnel News from Freddie Mac Multifamily, BH Properties, Matter Real Estate Group.

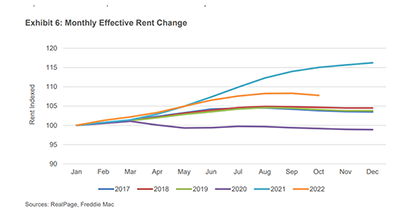

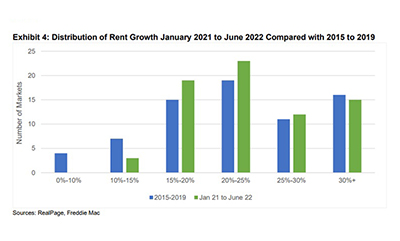

Multifamily Sector Fundamentals Could Moderate

After six months of healthy growth in multifamily fundamentals, Freddie Mac, McLean, Va., said the sector’s growth could moderate through the remainder of 2022.

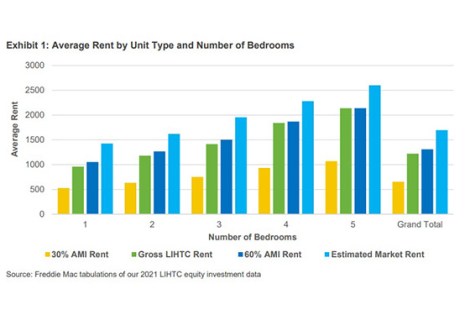

Former LIHTC Properties Remain Affordable, Freddie Mac Says

Multifamily properties that exit the Low-Income Housing Tax Credit program generally continue to rent at levels lower than those charged in the broader market, reported Freddie Mac Multifamily, McLean, Va.

Quote

“A fear has been that LIHTC properties would simply jack up rents to the top of the market at the expiration of their rent and income restrictions, generally about 30 years, but that’s not usually the case.”

–Steve Guggenmos, Vice President of Research & Modeling with Freddie Mac, McLean, Va.

Freddie Mac Multifamily Investment Index Drops

Freddie Mac, McLean, Va., said multifamily market investment conditions deteriorated in the first quarter as price appreciation and rising mortgage rates more than offset net operating income growth.