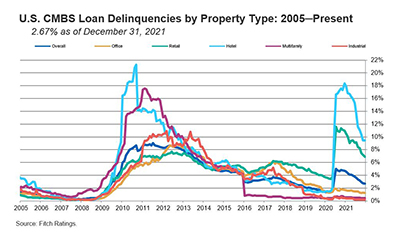

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell by 22 basis points to 2.10% in May, amid strong retail resolution volume and robust new issuance.

Tag: Fitch Ratings

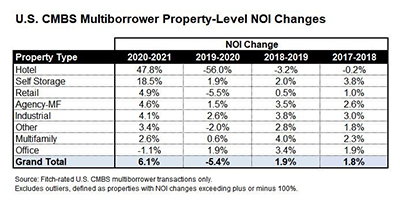

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.

Fitch Macroeconomic, Geopolitical Uncertainty Alter Global Outlook

Fitch Ratings, New York, said the Russia/Ukraine conflict, intensified inflationary pressures and a more aggressive interest rate schema could result in more adverse outlooks for much of the global economy.

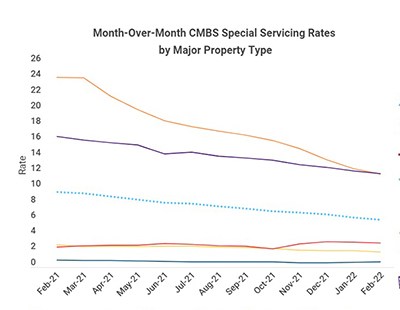

CMBS Delinquency, Special Servicing Rates Fall

The commercial mortgage-backed securities delinquency and special servicing rates both fell in February, analysts reported.

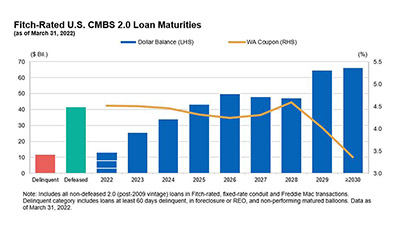

Fitch: Slowing Trend in CMBS Defeasance

Commercial mortgage-backed securities defeasance volume soared during late 2021 and into January, but that trend could be ending, said Fitch Ratings, New York.

Fitch: Some REITs Struggle with Coronavirus Effects

Fitch Ratings, New York, reported 17 percent of U.S. equity real estate investment trusts had negative outlooks in December, down significantly from a year ago.

Omicron Wave Weakens Hotel Revenue Recovery

Fitch Ratings, New York, said the global spread of the Omicron variant and new travel restrictions weaken the recovery prospects for hotel revenue per available room.

CMBS Delinquency, Special Servicing Rates Dip in December

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

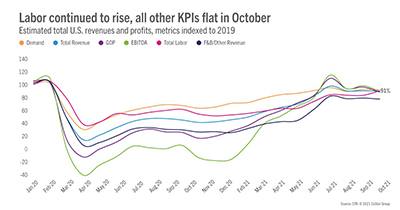

Hotel Profits, Recovery Forecast Improve

U.S. hotel profitability increased in October, and the sector’s recovery trajectory forecast has improved, STR and Fitch Ratings reported.

Fitch: REITs Can Withstand Short-Term Inflation Pressures

Fitch Ratings, New York, said it sees limited risks to real estate investment trust credit fundamentals from a transitory inflation-rate increase, but noted prolonged elevated inflation could pressure REITs.