Fitch Macroeconomic, Geopolitical Uncertainty Alter Global Outlook

Fitch Ratings, New York, said the Russia/Ukraine conflict, intensified inflationary pressures and a more aggressive interest rate schema could result in more adverse outlooks for much of the global economy.

In its latest Global Economic Outlook, Fitch updated its macroeconomic forecasts to factor in the energy price shock linked to the Russia/Ukraine conflict, intensified inflationary pressures and a more hawkish interest rate outlook. In addition to cutting its 2022 global GDP growth forecast and raising its Fed Funds rate forecast, Fitch flagged rising stagflation risks amid greater macroeconomic and geopolitical uncertainty.

In more adverse scenarios involving a surge in global oil prices lasting over a longer period with average annual prices of $150 per barrel in 2022 and $130 per barrel in 2023 would result in a “sustained period of outright energy rationing in Europe would be likely amid a rapid collapse in Russian energy export volumes.

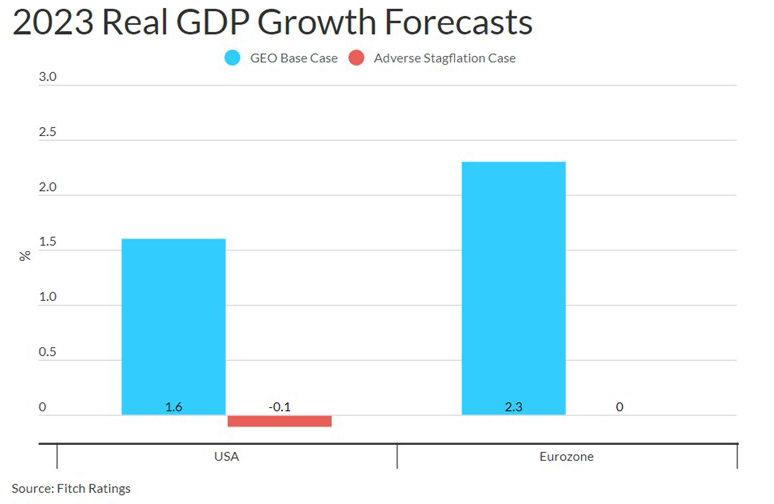

That scenario also assumes more pronounced global inflationary pressure—including U.S. inflation jumping above 10% and remaining in high single digits through the year. Fitch said that would mean much more aggressive monetary tightening, with the Fed Funds target coming in above 3% before year-end 2022. The U.S. and Eurozone growth would both fall to around zero in 2023 with unemployment rates rising by 1-2 percent.

Fitch assessed 208 sectors at the global and regional levels against the adverse case, measuring sector vulnerabilities against the likely macro feedthroughs and assessing these for the likely ratings impact on a five-part scale, ranging from “Virtually No Impact,” where Fitch would expect no rating or Outlook changes, to “Medium/High Impact” and “High Impact,” where it would expect numerous to most ratings being negatively affected.

For sovereigns, the adverse scenario was assessed to have the greatest effect on emerging Europe, Sub-Saharan Africa and APAC. Individual country-level exposures were also assessed. Sovereign support-driven ratings, or ratings that are capped by or credit linked to country ceilings and sovereign ratings, would subsequently be affected by sovereign actions.

“We expect Europe/Middle East/Africa and emerging Europe to be a focal point of higher risk,” the report said. “A majority of the regional sectors we found to be susceptible to a “Medium Impact” or “Medium/High Impact” were in EMEA. Air travel-related sectors including aircraft lessors, airports, airlines and aircraft ABS also generally showed higher levels of vulnerability although it varied regionally.

A number of global-level corporate sectors were assessed to be susceptible to a “Medium Impact” including those most exposed to supply chain risks and higher input costs such as building materials, building products, home builders, steel/aluminum, diversified industrials and those exposed to travel including Gaming, Lodging & Leisure, Aerospace and Airlines. Airlines were the only global sector assessed as likely to experience a “Medium/High Impact” under the adverse case. Compared to the sector average, issuers at the low end of the HY spectrum are likely to be disproportionately impacted as they tend to exhibit weaker business profiles and are also more exposed to widening spreads and more difficult refinancing conditions.

“That said, we largely found ratings well positioned to withstand the material increase in macroeconomic pressures delineated in our adverse case,” Fitch said. “We would expect 171 of the 208 sectors assessed at the regional and global level to likely experience “Virtually No” or only a “Mild/Modest Impact” with no or very few potential rating changes, respectively. Many ratings have improved positions coming out of the pandemic with stronger than expected performance and more robust balance sheets resulting in positive rating pressure and headroom. The specific nature of our ratings portfolio in a number of sectors and the lack of exposures of our rated entities also influenced our assessment of the likely limited ratings impact.”