The Mortgage Bankers Association, in a Mar. 27 letter to the Securities and Exchange Commission, said a proposed rule to curb certain material conflicts of interest in securitizations is flawed and would present risks to that market.

Tag: CMBS

CMBS Supply-Demand Fundamentals Improve Slightly

The outlook for the securitized commercial real estate market improved just slightly in the fourth quarter, the Moody’s Investors Service’s Red-Yellow-Green report said.

MBA Education: Introduction to Commercial Mortgage-Backed Securities May 4

A critical component of commercial real estate financing, commercial mortgage-backed securities involve numerous industry participants, provisions and considerations with how the security is ultimately structured. Join MBA Education and industry …

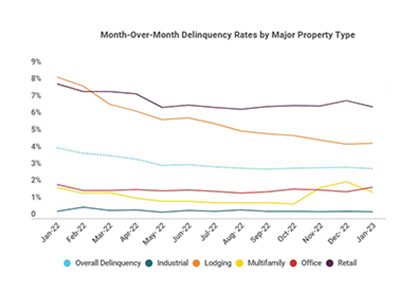

January CMBS Delinquency Rate Falls Below 3%

Trepp, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 10 basis points in January to 2.94%.

CMBS Delinquency, Special Servicing Rates Increase

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.

CMBS Supply-Demand Fundamentals Slip

Commercial property market supply and demand fundamentals slipped in the third quarter, reported Moody’s Investors Service, New York.

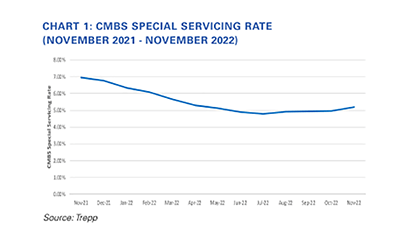

CMBS Special Servicing Rate Rises Again

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased in November for the fourth consecutive month.

CMBS Sector Outlook: Continued Uncertainty Going into 2023

Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.

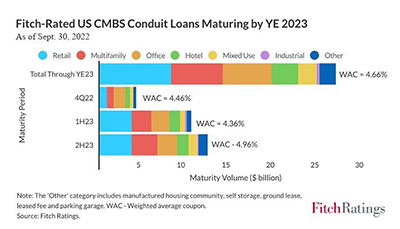

Fitch: Most Maturing CMBS Conduit Loans Can Refinance

Maturing commercial mortgage-backed securities loans have elevated refinancing risk due to rising interest rates and a weakening macroeconomic outlook, reported Fitch Ratings, New York.

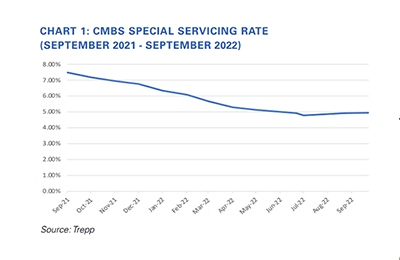

CMBS Delinquency Rate Falls; Special Servicing Rate Increases

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.