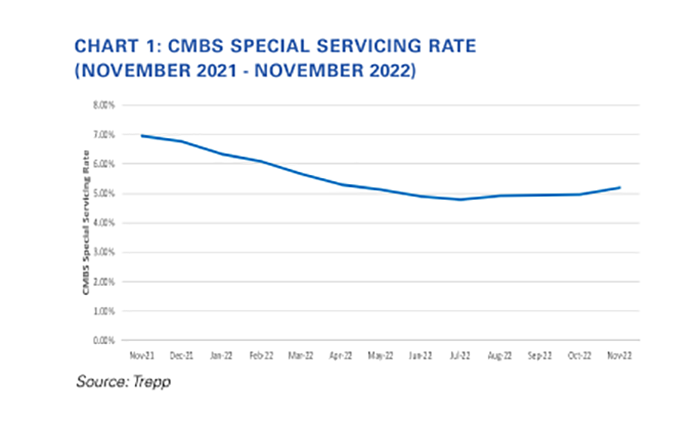

CMBS Special Servicing Rate Rises Again

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased in November for the fourth consecutive month.

The Trepp Special Servicing Report for December said the CMBS special servicing rate increased 23 basis points to 5.20%. Trepp Research Associate Jack LaForge called the figure a “stark jump” compared to the incremental increases of recent months.

A year ago the overall CMBS special servicing rate was 6.95%.

“The November rate represents the largest month-to-month increase since September 2020,” Trepp said.

The special servicing rate increase was driven mostly by hotel, multifamily and office transfers, Trepp reported. The multifamily special servicing rate increased 69 basis points, more than any other property type.

“Imminent maturity defaults are also proving to be a prime reason for special servicing transfers of late,” Trepp said. It noted three of the largest special servicing transfers in November were due to imminent maturity default, “as the current interest rate environment continues to make refinancing difficult.”

Looking at both CMBS 1.0 and CMBS 2.0 loans, the industrial sector special servicing rate held steady in November at 0.37%. The hotel sector rate increased 34 basis points to 7.06% and the multifamily sector rate increased 69 basis points to 2.33%. The office sector special servicing rate increased 14 basis points to 3.85% while the retail sector rate dipped 21 basis points to 11.01%.