The yield curve steepened significantly from the end of 2024 and through 2025. The Federal Reserve cut rates three times in 2025, leading to a decline in short-term rates while long-term rates remained elevated.

Tag: Chart of the Week

Chart of the Week: Potential Trajectories of Multifamily Completions

Developers have been building many apartment units over the past several years. We expect the pace of development to slow in the years ahead, given declining fundamentals including falling rents, rising vacancies, and increasing delinquencies in the multifamily sector (see MBA CREF Databook).

MBA Chart of the Week: Refinance-Driven Growth in CRE Mortgage Originations

This week’s Chart of the Week focuses on trends in commercial and multifamily originations, which saw a 36% increase year-over-year in the third quarter of 2025.

Chart of the Week: Multifamily Market Share by Capital Source

This Chart of the Week focuses on the distribution of the multifamily market share by capital source. The multifamily market is a fundamental part of the broader commercial real estate market, and originations have been strong throughout 2025. The figure reports MBA estimates of the shares of originations by each capital source, overlaid with total multifamily origination volumes.

MBA Chart of the Week: Monthly Payroll Growth and Unemployment

Job growth slowed to just 22,000 jobs in August and estimates for the prior two months were revised down by 21,000.

Chart of the Week: Selected Indexes of Housing Costs

The elevated cost burden of purchasing a new home since interest rates rose precipitously in 2022, has continued through mid-2025.

Chart of the Week: Latest Delinquency Rates and Range Since 1996

Commercial mortgage delinquencies increased across all major capital sources in the first quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report. While overall delinquency rates remain relatively low by historical standards, the increases highlight growing stress in parts of the market, particularly in sectors facing refinancing challenges or weakened fundamentals.

Chart of the Week: Total Commercial Real Estate Lending

According to MBA’s Annual Origination Summation, from 2020 to 2024, commercial and multifamily mortgage originations experienced notable shifts across investor types. The market peaked in 2021, driven by heightened activity across nearly all sectors, before experiencing a sharp decline in 2023. A modest rebound followed in 2024.

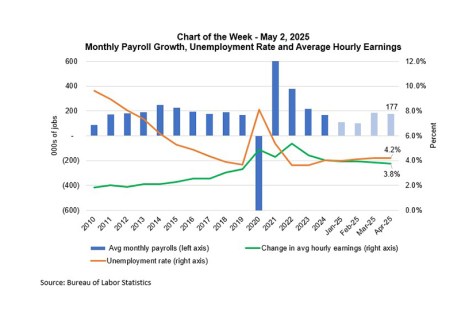

Chart of the Week: Monthly Payroll Growth, Unemployment Rate and Average Hourly Earnings

The April Employment Situation report showed that the job market continues to hold up. The pace of job growth slowed in April to a 177,000 gain, down from a downwardly revised 185,000 gain in March, but above the 152,000 average gain over the past 12 months.

Chart of the Week: Commercial and Multifamily Mortgage Debt Outstanding

According to MBA’s Quarterly Mortgage Debt Outstanding Report, total commercial and multifamily mortgage debt outstanding increased by 3.7% year-over-year, rising from $4.62 trillion in Q4 2023 to $4.79 trillion in Q4 2024. This growth reflects continued investment in commercial real estate, with sector-specific variations in debt allocation.