MBA CREF Forecast: Commercial/Multifamily Borrowing and Lending Expected to Increase to $576 Billion in 2024

Total commercial and multifamily mortgage borrowing and lending is expected to rise to $576 billion in 2024, which is a 29% increase from 2023’s estimated total of $444 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association (MBA).

MBA Announces Support for H.R. 7024, the Tax Relief for American Families and Workers Act of 2024

On Jan. 16, Sen. Ron Wyden, D-Ore., and Rep. Jason Smith, R-Mo., released H.R. 7024, the Tax Relief for American Families and Workers Act of 2024. The Mortgage Bankers Association strongly supports the bipartisan, bicameral bill.

CREF Policy Update Jan. 25: MBA Calls for Changes in Comments on Basel III Endgame Proposal

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Commercial and Multifamily People in the News Jan. 25, 2023

Industry personnel news from M&T Realty Capital Corp., JLL, Greystone and Cushman & Wakefield.

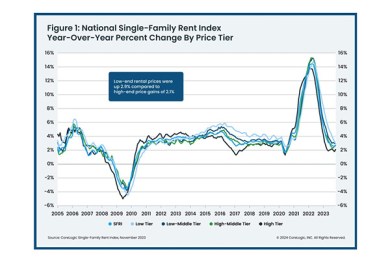

CoreLogic: Single-Family Rent Growth Continues Stable Pace

CoreLogic, Irvine, Calif., in its latest Single-Family Rent Index, found national single-family rent growth remained stable in November at 2.7%.

MBA NewsLink Q&A with Berkadia’s JV Equity & Structured Capital Group

MBA NewsLink recently interviewed Chinmay Bhatt, Noam Franklin and Cody Kirkpatrick from Berkadia’s JV Equity & Structured Capital Group about the state of the equity market.

Net Lease Cap Rates Expand; 2024 Expected to See Increased Transaction Volume

Overall, cap rates increased to 6.58%, up seven basis point from the prior quarter, Boulder said in its Fourth Quarter Net Lease Research Report.

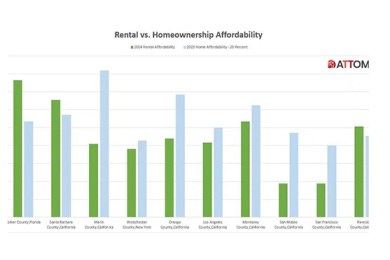

Renting, Buying Both Prompt Affordability Concerns, ATTOM Finds

ATTOM, Irvine, Calif., released its 2024 Rental Affordability Report, showing median three-bedroom rents in the U.S. are more affordable than owning a similarly sized home in the vast majority of local markets.