CREF Policy Update: Federal Reserve Keeps Rates Unchanged; Rate Cut in September?

Commercial and multifamily developments and activities from MBA important to your business and our industry.

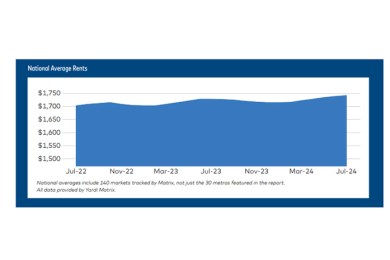

Yardi Matrix: July Multifamily Data Shows Positive Signs Despite Modest Rent Growth

Yardi Matrix, Santa Barbara, Calif., found multifamily advertised rents rose for the sixth straight month in July as demand from economic growth and demographics remained solid. The average rent increased $4 to $1,743, or 0.2% month-over-month, and is up by 0.8% year-over-year.

Redfin: Renter Population Growth Beats Buyers in Q2

Redfin, Seattle, released a recent report highlighting that the number of renter households in the U.S. grew more than three times faster than the number of homeowner households in Q2.

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The job market definitively slowed in July. Nonfarm payroll growth at 114,000 was well below the 12-month average of 215,000, while the unemployment rate moved up to its highest level since October 2021 at 4.3%, as shown in this week’s chart.

Unemployment Rises to 4.3% in July

Total nonfarm payroll increased by 114,000 in July, per the U.S. Bureau of Labor Statistics.

Lodging Econometrics Expects Hotel Supply Growth Through 2026

The hotel construction pipeline just reached a record.

Dealmaker: Greystone Provides $14.5M in Financing for Alabama Multifamily

Greystone, New York, has provided a $14.5 million Fannie Mae Delegated Underwriting & Servicing loan to refinance a 216-unit multifamily property in Hoover, Ala., near Birmingham.