MBA: Total Commercial Real Estate Borrowing and Lending Declined 47% in 2023

Total commercial real estate (CRE) mortgage borrowing and lending is estimated to have totaled $429 billion in 2023, a 47% decrease from the $816 billion in 2022, and a 52% decrease from the record $891 billion in 2021.

CREF Policy Update April 25: MBA, Coalition Responds to HUD’s RFI on Build America, Buy America

Commercial and multifamily developments and activities from MBA important to your business and our industry.

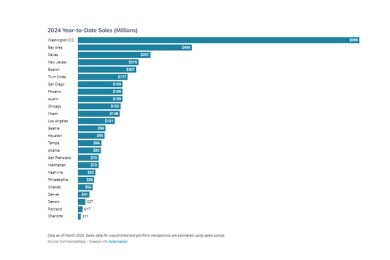

CommercialEdge: Q1 Office Sales Dip 17% From 2023

CommercialEdge, Santa Barbara, Calif., reported Q1 office sales fell to $5.4 billion, 17% below the 2023 first-quarter result.

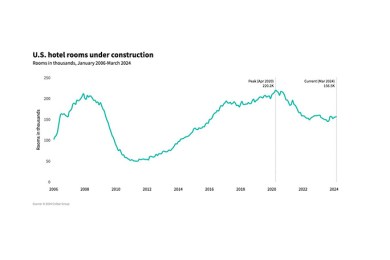

Hotel Construction Rises for First Time in Nine Months, CoStar Finds

The volume of U.S. hotel rooms under construction grew year-over-year for the first time since last June, according to CoStar Group, Washington, D.C.

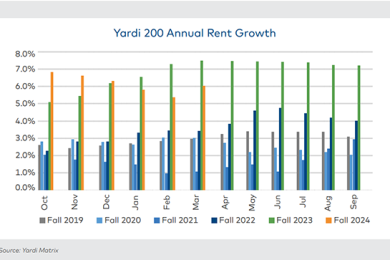

Student Housing Pre-Leasing, Rent Growth Outpace Historical Average

Student housing pre-leasing is outpacing all previous years on record and rent growth remained strong in March, according to Yardi Matrix, Santa Barbara, Calif.

MBA Statement on HUD Updates to Wind and Named Storm Requirements

MBA’s President and CEO Bob Broeksmit, CMB, released a following regarding the Department of Housing and Urban Development’s (HUD) updates to its wind and named storm policy for Federal Housing Administration (FHA) multifamily loans.

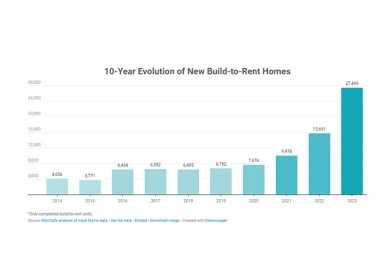

RentCafe: Build-to-Rent Housing Continues Boom

RentCafe, Santa Barbara, Calif., reported 27,500 build-to-rent homes were completed in 2023. That’s a 75% increase from 2022.

MBA Statement on HUD’s Federal Flood Risk Management Standard Final Rule

MBA President and CEO Bob Broeksmit, CMB, released a statement regarding the Department of Housing and Urban Development’s Federal Flood Risk Management Standard final rule.

Dealmaker: Calmwater Capital Originates $12M for California Retail Property

Calmwater Capital, Los Angeles, provided Irvine, Calif.-based West Hive Capital with $12.25 million in short-term first mortgage debt for a neighborhood retail property in Rancho Palos Verdes, Calif.