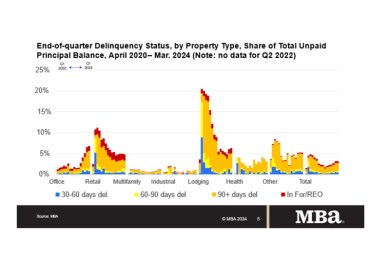

Delinquency Rates for Commercial Properties Flat in First Quarter of 2024

Delinquency rates overall for mortgages backed by commercial properties were unchanged during the first quarter of 2024, but loans backed by office properties continued to see a rise in delinquencies. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance (CREF) Loan Performance Survey.

CREF Policy Update April 18: MBA Joins Broad Coalition Letter Defending Efficacy of Section 1031 Like Kind Exchanges

Commercial and multifamily developments and activities from MBA important to your business and our industry.

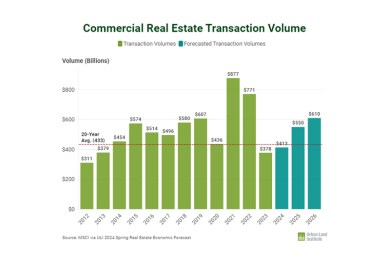

Urban Land Institute: 2024 Will Continue to See Challenges, but Optimism Ahead

The Urban Land Institute, Washington, released its Real Estate Economic Forecast for Spring 2024. Among the major takeaways–while 2024 is seeing a solid economy, high interest rates continue to weigh on the industry.

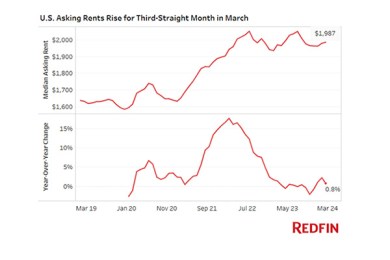

Asking Rents Rose Again in March, Redfin Found

Redfin, Seattle, found median asking rents rose 0.8% year-over-year in March, in the third consecutive increase.

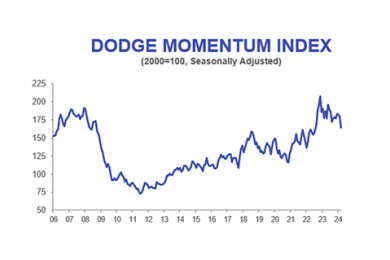

Commercial Real Estate Entering Planning Stage Dips

The Dodge Momentum Index fell 8.6% in March to 164.0, and commercial properties entering the planning stage dipped 3.2%, according to the Dodge Construction Network, Bedford, Mass.

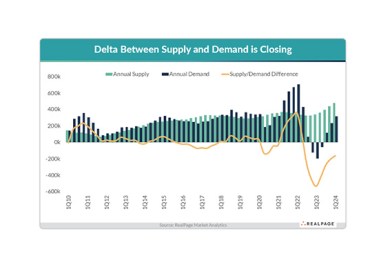

RealPage Q1 Apartment Results: Supply Side Dominates Story

RealPage, Richardson Texas, reported that a major influx of apartment supply is continuing to temper rent and occupancy figures in the quarter.

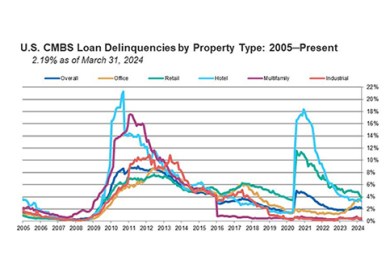

High Resolution Volume Drives CMBS Delinquency Rate Lower, Fitch Reports

The U.S. commercial mortgage-backed securities delinquency rate decreased nine basis points to 2.19% in March, according to Fitch Ratings, New York.

Dealmaker: Dwight Capital, Dwight Mortgage Trust Close Multiple Deals

Dwight Capital and its affiliate REIT, Dwight Mortgage Trust, announced a number of deals in March.