MBA’s Q3 2023 Commercial/Multifamily DataBook Provides Insights as New Year Begins

Commercial real estate markets are entering the new year relatively stuck. Through the first three quarters of 2023, property sales and mortgage origination volumes are each down 50-plus percent compared to the year prior.

CREF Policy Update Jan. 4: FDIC (Re)Advises Caution for Banks With Large CRE Concentrations

Commercial and multifamily developments and activities from MBA important to your business and our industry.

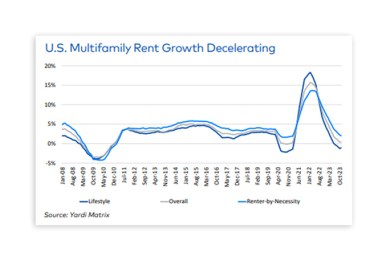

Yardi Matrix: 2024 Multifamily Outlook Mixed

Yardi Matrix, Santa Barbara, Calif., released an outlook for the multifamily market in 2024, pointing to expectations as “mixed.”

MBA NewsLink Roundtable: Top Commercial Mortgage Servicing Issues to Watch in 2024

Commercial and multifamily mortgage loan originations were 49% lower in the third quarter of 2023 compared to a year ago and decreased 7% from the second quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. While a full-year 2023 view will not be available for a little while, it was a down year.

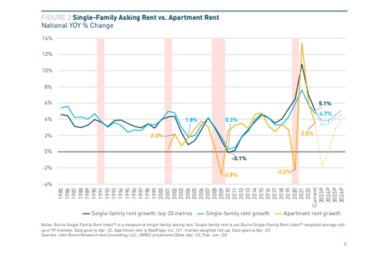

Berkadia: Single-Family Rental Market Continues Robust Growth

Berkadia, New York, released its latest outlook on single-family rentals and build-to-rent properties, finding the single-family rental market is the fastest-growing segment in the nation’s housing landscape.

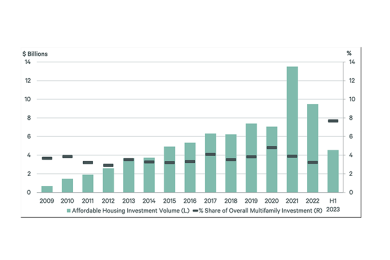

CBRE: Affordable Housing Investment Down From 2021, but Still Strong

CBRE, Dallas, found affordable housing investment trends over the past few years have tracked some aspects of the overall multifamily market.

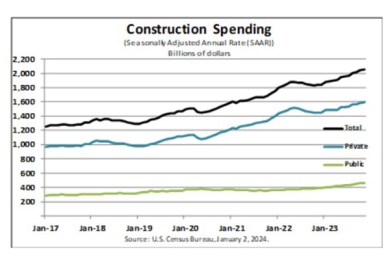

Construction Spending Grows Again in November

Construction spending grew at a seasonally adjusted annual rate of $2,050 billion during November, 0.4% higher than in October, the U.S. Census Bureau reported Tuesday.