Trepp: Interest Rates Hit 2Q Life Insurance Mortgage Returns

Trepp LLC, New York, said life insurance company commercial mortgage investments fell again in the second quarter, largely due to increasing interest rates.

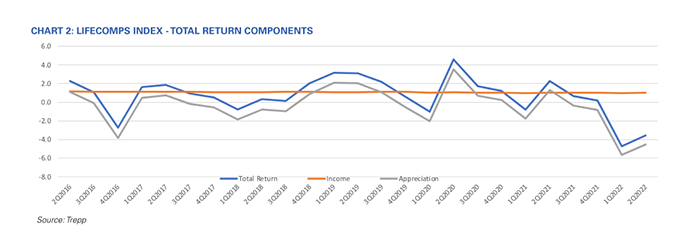

The Trepp LifeComps Total Return Index fell to -3.55 percent for the second quarter, pushing its year-to-date total return down to -8.09 percent. “The 2022 year-to-date return is the lowest on record for the index going back to the fourth quarter of 1996,” said Stephen Buschbom, Research Director with Trepp. “To put the performance in perspective, there has been only one other period where the index posted back-to-back negative returns over two quarters: third- and fourth-quarter 2008.”

While recent performance resembles the 2008 Great Recession, the LifeComps index decline throughout 2022 has been primarily driven by rising treasury rates, “rather than rapidly deteriorating credit quality or dramatic increase in credit spreads,” Buschbom said.

Buschbom noted the LifeComps index for the third quarter will likely mirror the first two quarters “given that commercial mortgage-backed securities loan distress remains low and Treasury rates are on track to end the third quarter higher.” He said the five-year Treasury rate is up by nearly the same amount as seen in the second quarter, which could put the third-quarter total return in the -3.5 percent ballpark. This performance would push the year-to-date total return toward a double-digit decline.