Retail Comeback Continues with Soaring Rent Growth

Retail’s journey from underdog to a favored asset class continues, reported JLL, Chicago.

Increased occupancies, population growth and low new product deliveries mixed with high construction costs are all driving retail market rent growth, making the sector more attractive to investors, JLL said.

The top eight markets with high population growth are also leading when it comes to rental growth. With a nearly 63% growth in rental rates since 2011, Nashville is the top momentum market, followed by south Florida at 47.1% and Austin and Tampa both at 39%. Other top markets for rental growth include Denver with 37% and Charlotte, Dallas-Fort Worth and Raleigh-Durham, all with nearly 30% rental growth. These momentum markets have seen rental growth since 2011 above the national 10-year rent growth of 27.7% along with a population growth above the 10-year national average of 7.4%.

“Retail follows consumers, rent growth follows both and investors follow all three,” said JLL Senior Managing Director Danny Finkle. “These markets are already outperforming right now, and their market dynamics suggest they will continue to do so.”

Rental growth is aided by the continued rise in occupancy that has yet to be offset by retail deliveries, which peaked in 2017 with nearly 30 million square feet delivered across those momentum markets. As deliveries have decreased each year since 2017–with one notable exception in 2020–occupancy has increased to its year-end 2021 level of 95.5%, JLL said.

2022 kicked off with a positive retailer outlook due to store openings outpacing store closings for the first time after three years of consecutive net closures. Year to date, only 11 retailers have announced roughly 720 store openings over the next two years with only 47 closures.

“Total space demanded by the store openings is almost double the space that will be vacated,” added JLL Senior Managing Director Barry Brown. “This provides additional stability for investors in retail assets.”

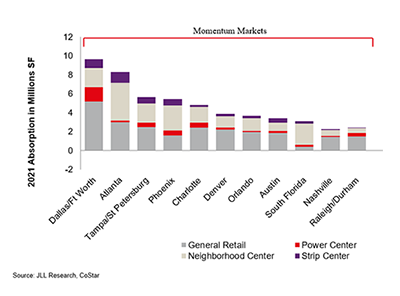

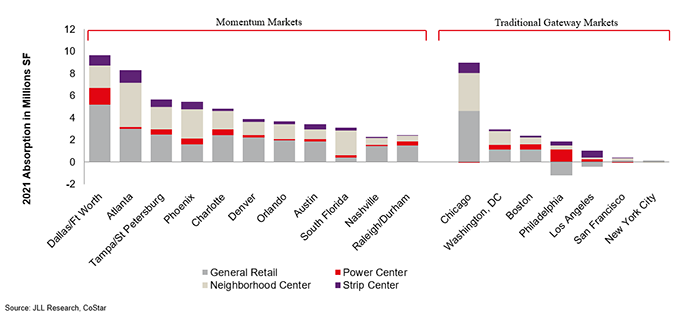

Additionally, the net absorption in growth markets like Dallas-Fort Worth, Atlanta, Tampa, Phoenix, Charlotte, Denver and Orlando is exceeding most of the traditional markets, JLL said.

JLL Senior Managing Director Chris Angelone noted institutional investors have been paying attention to rental growth opportunities over the past few years and have deployed strategies to increase allocations to these momentum markets. “The reality is, with so little new retail construction, there is upward pressure on rents across the country for high-quality retail,” he said. “Owners and investors will see outperformance across their portfolios.”