Record-Breaking Start for U.S. Multifamily Market

CBRE, Dallas, reported the multifamily sector saw strong momentum in early 2022, with robust demographic trends underpinning record leasing activity, rent growth and investment.

Investment in the multifamily sector increased by 56 percent year-over-year to $63 billion in Q1 2022–the strongest first quarter CBRE has seen–which increased the trailing four-quarter total to $374 billion. Multifamily accounted for 37 percent of total commercial real estate investment volume, followed by office at 21 percent and industrial at 20 percent.

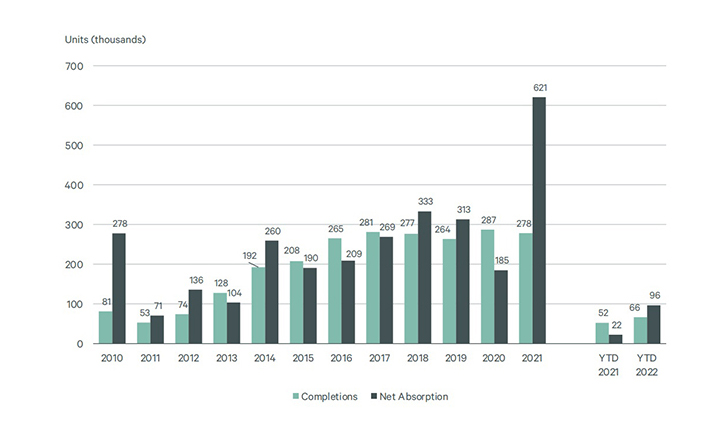

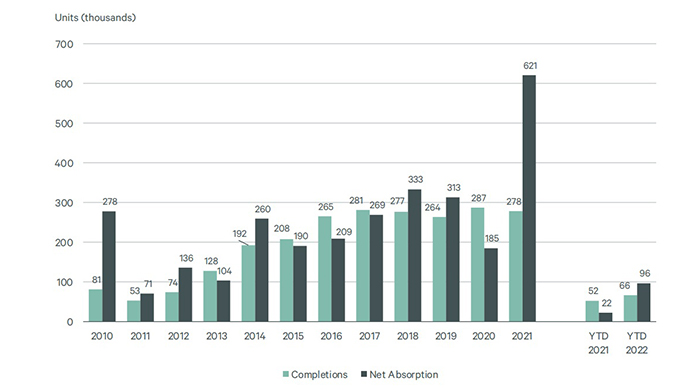

The multifamily market set a record four-quarter absorption total of 695,100 units in Q1 2022–up 12 percent from the previous quarter and 77 percent higher than the previous annual record of 393,000 units in 2000. Net absorption equaled 96,500 units, the highest first-quarter total since 2000.

“Strong multifamily fundamentals persist, with favorable migration trends, high household formation and strong wage and job growth contributing to continued demand,” said Brian McAuliffe, President of Multifamily Capital Markets for CBRE.

McAuliffe noted “abundant” equity and debt capital remains available, albeit at significantly higher rates than in the past few years.

“Looking ahead, while investors continue to have strong convictions on market fundamentals, bidder pools have reduced due to the increase in the number of offerings in the market and we are experiencing upward movement in cap rates as debt volatility impacts pricing,” McAuliffe said.

The overall multifamily vacancy rate fell by 20 basis points quarter-over-quarter and 2.5 percentage points year-over-year to a record-low 2.3 percent, CBRE said. Average net effective rent increased by 15.5 percent year-over-year to $2,007 per month. Average rents now exceed their pre-pandemic levels in all but two of the 69 markets tracked by CBRE, San Francisco and San Jose.

New deliveries exceeded 66,000 units in Q1 2022, bringing the four-quarter total to 292,500–the highest amount since 1987. With more than 400,000 units currently under construction, 2022 deliveries will likely eclipse 2021, the report said.

New York, Houston, Dallas, Austin and Washington, D.C. ranked among the top five markets for new deliveries over the past four quarters, accounting for 28.7 percent of the national annual total and 29.8 percent in Q1 2022. Texas markets were among the most active over the past four quarters, with 59,700 units delivered and 122,300 units absorbed in Houston, Dallas/Ft. Worth, Austin and San Antonio.

The top markets for net absorption included New York (17,200), Houston (6,700), Chicago (5,900), Dallas (4,600) and Washington, D.C. (4,000).

All 69 markets CBRE tracked had positive rent growth year-over-year, with the increase reaching double digits in 56 markets. Average rents now exceed their pre-pandemic levels in all but two of the markets examined.

CBRE said 17 markets had vacancy rates below 2.0 percent, led by Newark, N.J. (1.0 percent), Madison, Wis. (1.1 percent) and Providence, R.I. (1.2 percent). Only 11 markets had vacancy rates above 3.0 percent, down from 20 in late 2021. Those that dropped below 3 percent in Q1 2022 included Seattle (2.9 percent), San Jose (2.9 percent) and Chicago (2.8 percent).