LightBox RCM: Commercial Real Estate Navigating a Balancing Act

LightBox RCM, Carlsbad, Calif., said commercial real estate investors are “navigating a delicate balancing act” as strong demand across many sectors hits headwinds from inflation, construction costs and labor issues.

The firm’s Investor Sentiment Report said inflation is driving both capital migration into the industry and increased costs across investment and construction sectors.

“Today’s capital markets climate may be one of the most dynamic and intricate we’ve seen in many years,” said Tina Lichens, Senior Vice President of Broker Operations with LightBox. “Investors are navigating a complex environment with significant opportunities as well as economic headwinds that are dictating a more nuanced approach. We expect to see subtle shifts in investment approaches and strategies as a result.”

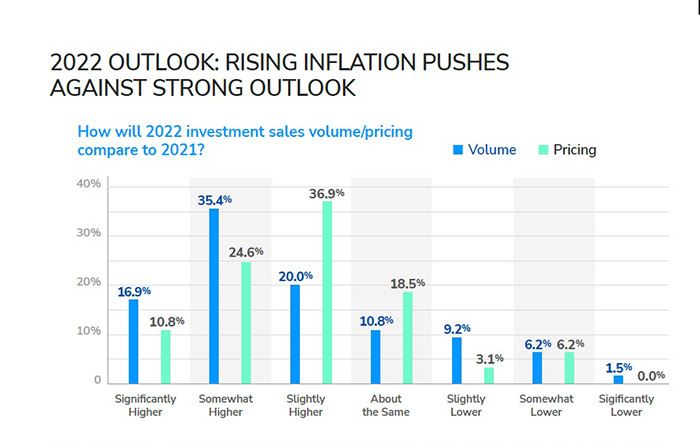

The report found 52 percent of industry professionals expect this year’s investment activity will be somewhat or significantly higher than last year’s activity despite price increases on materials. At the same time, just over one-third of respondents said they believe investment sales pricing will be somewhat or significantly higher this year than last.

The recent Russian invasion of Ukraine added another layer of potential volatility as industry practitioners debate the potential impact on oil, commodity pricing and other factors, LightBox said.

The report also noted rising interest rates and construction costs–largely due to inflation–represent the sector’s biggest threats. Participants rated various factors affecting commercial real estate on a scale of one to five. Inflation, now at levels not seen in decades, scored a 3.77 rating while rising interest rates and increasing construction costs rated 4.08 and 3.92, respectively. The state of distressed real estate ranked as the least concerning factor at 2.20.

Nearly three-quarters of respondents said they expect commercial property investment sales volume to exceed last year’s level; a similar level expects pricing levels will increase, too.

While 52 percent of survey participants said they believe CRE transaction activity will increase somewhat or significantly this year compared to 2021, only 35 percent said they believe pricing will increase somewhat or significantly.

“For all of the challenges the economy faces–inflationary shifts, labor shortages and supply chain disruption–there is great and widespread optimism for what lies ahead for the economy and commercial real estate,” the report said. “In fact, the bullish sentiment projected by some extends for the next three to five years.”