MBA: 4Q Commercial, Multifamily Mortgage Delinquencies Decline

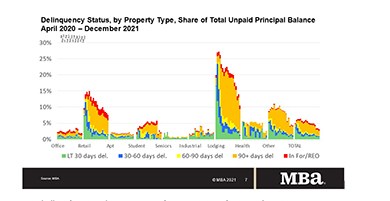

Delinquency rates for mortgages backed by commercial and multifamily properties declined during the last three months of 2021, the Mortgage Bankers Association's latest CREF Loan Performance Survey reported.

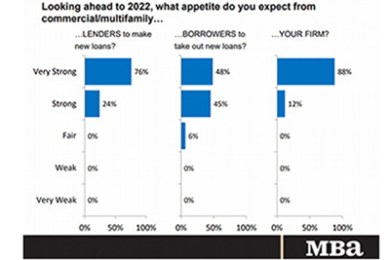

MBA CREF Outlook Survey: Originators Bullish on 2022 Outlook

Commercial and multifamily mortgage originators anticipate 2022 will be another strong year of borrowing and lending, according to the Mortgage Bankers Association's 2022 Commercial Real Estate Finance Outlook Survey.

CREF Policy Update Jan. 13, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

2021 Commercial Property Prices Increase Nearly 25%

Green Street, Newport Beach, Calif., said its commercial property price index increased 24 percent in 2021 with robust price appreciation occurring in virtually every corner of the CRE market.

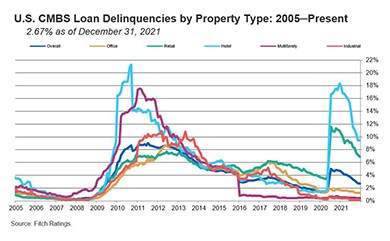

CMBS Delinquency, Special Servicing Rates Dip in December

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

Personnel News from M&T Realty Capital Corp., Akerman, JLL, Transwestern

In an expansion of its current leadership team, M&T Realty Capital Corp., Baltimore, announced Michael Edelman, previously Group Vice President, has been named President of the organization.

Student Housing Fundamentals Show Resiliency

Yardi Matrix, Santa Barbara, Calif., reported student housing sector fundamentals remain strong as pre-leasing for the 2022 fall semester ramps up.

Renting Less Affordable Than Home Ownership in Most U.S. Markets

Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 58 percent of U.S. counties, reported ATTOM, Irvine, Calif.

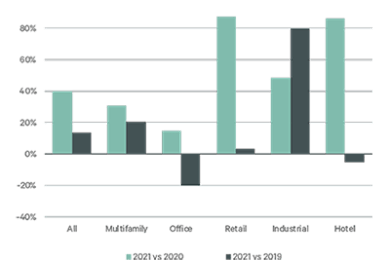

CBRE: Investor Interest in Commercial Real Estate Surpasses 2019 Level

Investor interest in commercial real estate remains strong despite increased uncertainty due to rising COVID-19 infections and a reduction in the Federal Reserve’s bond purchasing program, reported CBRE, Dallas.

Millennials, Gen Z Continue to Lag Behind in Homeownership

Millennials and Gen Z—the most underrepresented cohorts in homeownership—continue to lag behind after nearly two years into the coronavirus pandemic, according to a survey by PropertyShark, New York.