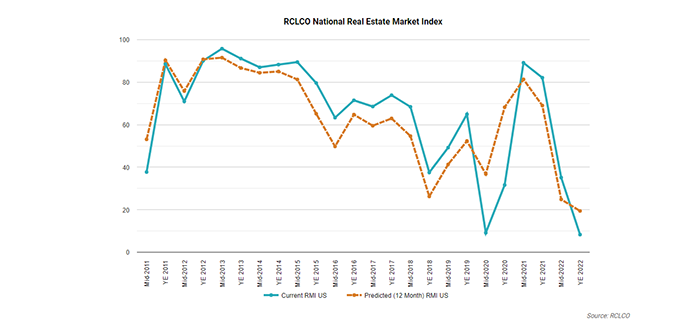

RCLCO: Real Estate Sentiment Hits Record Low as Recession Looms

RCLCO, Washington, D.C., reported its Real Estate Market Sentiment Index decreased 26.9 points over the past six months and dropped 80.6 points since the most recent peak.

The index fell to a record low 8.5 at year-end 2022. “This puts the index solidly into a period of real estate market distress/recession and is in line with the level experienced in the first months of the COVID-19 pandemic in 2020,” the report said.

RCLCO noted the sentiment index saw its largest decline ever in first-half 2020 as the pandemic shuttered large swaths of the economy and affected everyday routines. It dropped from 64.9 in early 2022 to a then-new low 9.2. The index bounced back to 89.1 by mid-2021 as the economy recovered rapidly and the nation returned to some semblance of new normal. “[But,] after a more optimistic 2021, the index declined significantly in 2022…as the combination of geopolitical uncertainty, persistent high levels of inflation and rising interest rates have pushed the economy into a recessionary zone,” RCLCO said.

Respondents indicate they believe the real estate market may have hit its low point, or will reach in in the near future. The report’s future sentiment index is forecast to increase more than 11 points to 19.4 over the next 12 months.

“Perhaps not surprisingly, three quarters of respondents believe that real estate conditions will get moderately or significantly worse in the next 12 months, though the majority of these respondents feel conditions will only be moderately worse,” RCLCO noted.

Many survey respondents called a national economic recession “imminent.” Nearly all–93%–said they believe there will be a recession within the next two years and a strong majority (82%) believe it will occur within the next 12 months or is already here.

In one sign of relative optimism, 90% of respondents said they anticipate that the looming recession will likely be shallow and of moderate duration.

But consistent with the report’s generally pessimistic outlook, more than 25% of respondents indicated their companies have slowed hiring and 16% have a hiring freeze, while only a 5% share said they are hiring at higher levels.