FHFA, Treasury Suspend Portions of GSE 2021 Preferred Stock Purchase Agreements

The Federal Housing Finance Agency and the Treasury Department on Tuesday suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac in January.

FHFA Issues Proposed Rulemaking to Amend GSE Regulatory Capital Framework

It's been a busy week for the Federal Housing Finance Agency. On Tuesday, FHFA and the Treasury Department suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac. On Wednesday, FHFA announced a notice of proposed rulemaking to amend the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

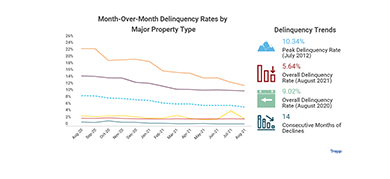

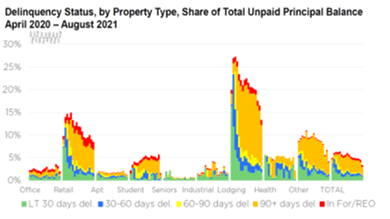

MBA: Commercial, Multifamily Delinquencies Continue Downward Trend

Delinquency rates of mortgages backed by commercial and multifamily properties have broadly improved in recent months, according to two new Mortgage Bankers Association reports.

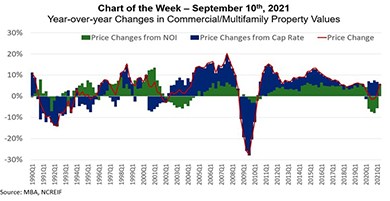

MBA Chart of the Week: Commercial/Multifamily Property Values

Commercial and multifamily property prices are the product of two things: a) the net operating income (NOI) a property produces and/or is expected to produce and b) the multiple of that income (the capitalization or “cap” rate) investors are willing to pay in order to own that income stream. Thus, Property Value = NOI/Cap Rate.

MBA, ‘Main Street Employers’ Urge Restraint on Tax Measures

Congress is currently wrestling with several large economic bills—including a massive $3.5 trillion Administration-backed infrastructure bill as well as numerous fiscal year 2022 budget proposals. How to pay for these measures remains hotly debated.

MBA Appoints Amber Lawrence as AVP of Diversity, Equity and Inclusion

The Mortgage Bankers Association appointed Amber Lawrence as Associate Vice President of Diversity, Equity and Inclusion, responsible for advancing DEI programs for the association and overall real estate finance industry.

C-PACE Makes Splash with Debut New York Deal

Commercial Property Assessed Clean Energy (C-PACE) is an innovative commercial real estate financing option that remains not very well known nor understood by many commercial/multifamily market participants.

Personnel News From JLL, Walker & Dunlop

JLL Valuation Advisory hired structured finance specialist John Oates to join its Renewable Energy Valuation team as a Managing Director based in Tampa, Fla.

Dealmaker: Newmark Lines Up $230M to Refinance Edition West Hollywood Hotel

Newmark, New York, arranged $230 million to refinance the Edition West Hollywood hotel on Sunset Boulevard in Los Angeles.

Hotel Metrics, Debt Markets Bounce Back

The hotel sector continues to bounce back from a devastating 2020, according to new reports from STR and JLL Hotels.