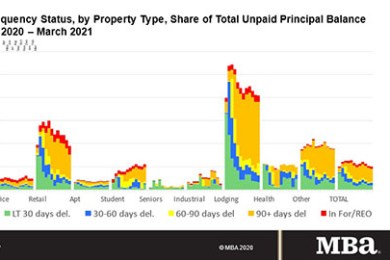

MBA: March Commercial/Multifamily Mortgage Delinquencies Fall for 3rd Straight Month

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in March, reaching the lowest level since the onset of the COVID-19 pandemic, according to the Mortgage Bankers Association's latest monthly MBA CREF Loan Performance Survey.

CDC Extends National Eviction Moratorium to June 30

The Centers for Disease Control and Prevention announced this week an extension to the eviction moratorium further preventing the eviction of tenants who are unable to make rental payments. The moratorium that was scheduled to expire on March 31 is now extended through June 30.

A Conversation with MBA Affordable Housing Advisory Council Co-Chairs

The Mortgage Bankers Association recently created two Affordable Advisory Councils, dedicated to supporting CONVERGENCE, the MBA Affordable Housing Initiative. These Councils are currently led by four senior executives: Christine Chandler (M&T Realty Capital Corp.), Tony Love (Bellwether Affordable Housing Group), Anthony Weekly (Truist Bank) and David Battany (Guild Mortgage).

mPact’s Commercial Production Advisory Council Welcomes Maggie Burke as Chair

The Mortgage Bankers Association's young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Office Demand Approaches Pre-COVID Levels in Some Large Market

One year after the pandemic started, demand for office space in the country’s largest markets is approaching pre-COVID levels and recovery appears to be looming for several markets, reported VTS, New York.

Hotel Debt Markets Improving

The hospitality debt market is showing a resurgence as the lodging industry continues to recover, said JLL, Chicago.

Bridge Lending is Trending

Bridge lending remains an active piece of the commercial real estate finance pie heading into the anticipated economic recovery in the second half of 2021. Short-term loans with floating interest rates that are higher than longer term fixed-rate loan rates are written for properties in transition.