MBA Urges Support of Affordable Housing Provisions to House Infrastructure Bill

The Mortgage Bankers Association sent a letter to the House Transportation and Infrastructure Committee on Tuesday urging support for two provisions that support affordable housing incentives.

CREF Policy Update June 10, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

JLL: Offices Will Evolve as They Re-Emerge

JLL, Chicago, said it expects offices to re-emerge as the “beating heart” of re-energized central business districts as the recovery progresses.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance Through Sept. 30

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30, subject to the continued tenant protections FHFA has imposed during the pandemic. This is the third extension of the programs, which were set to expire June 30.

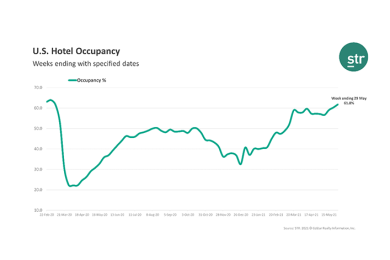

Hotel Profits Improve as Recovery Spreads

STR, Hendersonville, Tenn., said hotels saw an encouraging April as more revenue flowed through to the bottom line.

Fitch: Urban Multifamily Recovery Years Away Despite Demand Growth

Urban multifamily rental demand is improving as pandemic restrictions are lifted and workers return to offices, but a full recovery could take longer than prior recoveries, reported Fitch Ratings, New York.

Dealmaker: Mesa West Capital Funds $178M For Office Acquisition, Conversion

Mesa West Capital, Los Angeles, provided Longfellow Real Estate Partners, Boston, with $178 million for San Mateo Bay Center, a 235,900-square-foot office campus in San Mateo, Calif.

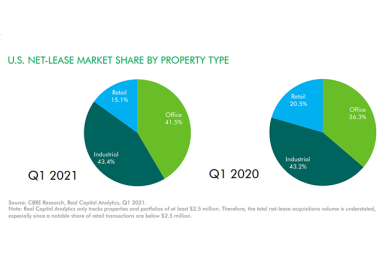

Net-Lease Investment Approaches Pre-Pandemic Level

Investment in U.S. net-lease properties approached pre-pandemic levels in the first quarter, reported CBRE, Dallas.

Commercial/Multifamily Briefs from Blackstone, QTS, JLL

Data center real estate investment trust QTS Realty Trust, Overland Park, Kansas, and Blackstone, New York, announced that Blackstone affiliates will acquire all outstanding shares of common stock of QTS Realty Trust for $78 per share in an all-cash transaction valued at nearly $10 billion, including the assumption of debt.