MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

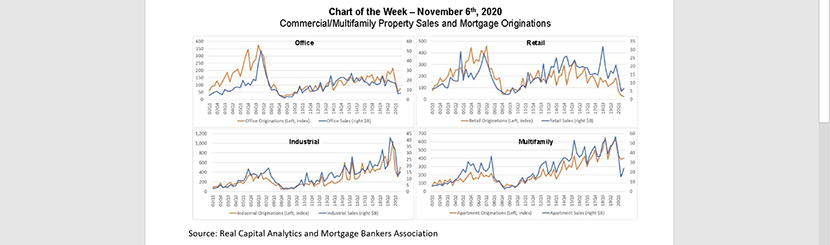

The COVID-19 recession is affecting different commercial property types in very different ways. Retail and lodging properties have felt the most immediate and dramatic impacts of the virus, while industrial properties have come to be viewed as countercyclical – getting a boost from the increased logistics demand of online orders. According to data from Real Capital Analytics, third-quarter year-to-date sales of retail properties are down 45% compared to a year earlier, while sales of industrial properties are down “only” 25%.

MBA’s data on mortgage bankers’ originations is similarly divergent across the two property types, but with greater declines for each, with retail originations down 67% and industrial originations down 35%. Office properties, with longer leases and fewer near-term impacts, fall somewhere between the two, with year-to-date sales volumes off 45%, and originations down by a nearly identical 47%.

The apartment market is where the story gets more interesting. Sales of multifamily properties fell 41% when comparing the first three quarters of 2020 to the same period in 2019 – roughly in line with the decline in sales of office and retail properties. However, originations fell by only 17% – half the decline of industrial, one-third the decline of office, and one-quarter the decline of retail.

Although the pandemic is creating uncertainty among investors and lenders about how to properly underwrite many properties, low interest rates and stable property values have been drawing borrowers to refinance multifamily mortgages at a rapid clip – particularly through FHA and GSE mortgages. While total mortgage bankers originations are down 35% year-to-date, multifamily is down 17%, with originations for the GSEs down 3% and up 144% for the FHA market. That refinancing boom has led to a gap in the traditionally tight relationship between commercial and multifamily property sales and mortgage originations volumes – both for multifamily and for market totals overall.

–Reggie Booker rbooker@mba.org; Jamie Woodwell jwoodwell@mba.org.