MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019's record $601 billion, according to a new Mortgage Bankers Association forecast.

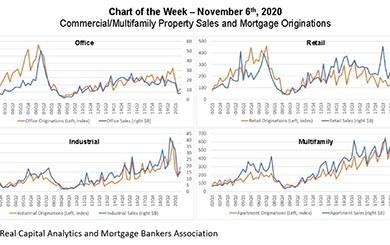

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

CREF Highlights Nov. 12, 2020

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Andrew Foster: Trade Associations–Community Building in Unsettling Times

I have always believed, and I still believe, that whatever good or bad fortune may come our way we can always give it meaning and transform it into something of value. -Hermann Hesse

ULI Forecast Sees Potential Rebound in 2021-2022

The Urban Land Institute, Washington, D.C., said a consensus of real estate economists surveyed expect a short-lived recession and above-average GDP growth in 2021 and 2022.

Dealmaker: Greystone Provides $48M for Two Multifamily Assets

Greystone, New York, provided $48.2 million in HUD-insured loans to refinance multifamily properties in Virginia and Arizona.

Signs of Retail Sector Distress Grow

The retail market is starting to see distress as the pandemic enters its ninth month, said Moody's Analytics REIS, New York.

CMBS Delinquency Rate Falls; Issuance Bounces Back

The commercial mortgage-backed securities delinquency rate continued to fall in October while issuance increased, said Trepp LLC and KBRA, New York.

COVID Upends CBD Real Estate

The COVID pandemic is wreaking havoc on commercial and residential real estate, especially in central business districts, said Wells Fargo Securities, Charlotte, N.C.