The Latest on LIBOR Transition with Metlife’s Reena Pally

MBA NewsLink interviewed Reena Pally, Managing Director of Real Estate Debt Strategies with MetLife Investment Management, about the transition away from LIBOR to a successor index for floating-rate loans.

MBA NEWSLINK: The transition away from using the LIBOR rate to price loans and other financial instruments is an important shift for lenders. Can you highlight key areas that institutions should be focused on to prepare now that we are approximately 18 months from the earliest cessation date of January 1, 2022?

REENA PALLY: Commercial real estate industry participants have made meaningful progress in terms of educating themselves and their partners on the broader USD LIBOR-SOFR transition. To date, many firms have developed governance structures, quantified LIBOR exposure and implemented fallback language.

There are several more things lenders can do today to prepare for the upcoming transition. Systems readiness is critical at this juncture. It’s important to collaborate with technology teams to ensure platforms and systems are capable of processing transactions utilizing new benchmarks. Additionally, spread adjustment fields should be evaluated and confirmed to ease transition of existing loans.

Strong partnership with key constituents remains a top priority. Working with legal partners to refine and/or continue to implement fallback language will facilitate a smooth transition to SOFR or other replacement rates. Communication with loan servicers to ensure readiness for the transition should also continue.

We continue to monitor liquidity in replacement benchmark rates and view ongoing market developments as the best gauge for an orderly transition. This process includes assessing volumes in the new issue market, futures, swaps and options. On March 2, 2020, the Federal Reserve, began to publish 30-, 90- and 180-day SOFR Averages as well as a SOFR Index, in order to support a successful transition away from USD LIBOR. Cleared interest rate derivatives are scheduled to begin using SOFR for discounting calculations in October 2020, and we are optimistic that this change will be an important step in building liquidity in SOFR-linked products. The collective market developments toward the migration to SOFR and other global replacement benchmark rates have been largely positive, and market acceptance is reflected through continuous education, ongoing transition preparedness and improved market liquidity.

NEWSLINK: There seems to have been a large amount of focus on the transition for the prior three to six months before COVID-19 impacts were felt in the U.S. Could you describe a few recent developments and why they are important?

PALLY: There has been a flurry of activity recently. To highlight a few important announcements:

- On May 27, 2020, the ARRC published Recommended Best Practices https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2020/ARRC-Best-Practices.pdf

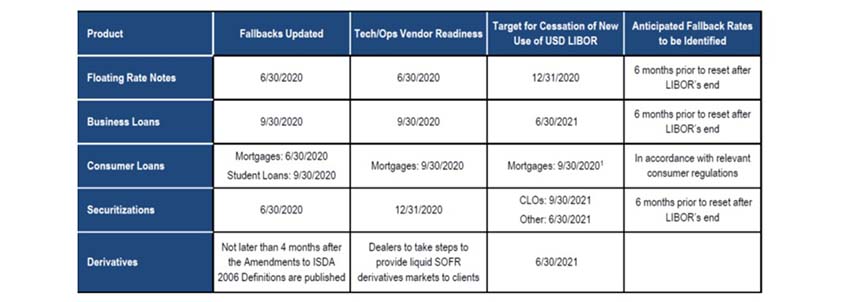

The ARRC Best Practices serve as a roadmap with key dates for market participants, which vary slightly depending on asset type (see chart below). Each institution should review the Best Practices document and milestones.

As an example, Business Loan lenders should target the following:

- Incorporate ARRC recommended (or substantially similar) hardwired fallback language by 9/30/20.

- Third-party technology and operations vendors relevant to the transition should complete all necessary enhancements to support SOFR by 9/30/2020.

- Cease issuance of new USD LIBOR based loans by 6/30/2021.

- For contracts specifying that a party will select a replacement rate at their discretion following a LIBOR transition event, the determining party should disclose their planned selection to relevant parties at least six months prior to the date that a replacement rate would become effective.

Every institution should consider the Best Practices and develop an approximate timeline, if not already determined.

- On June 18, 2020, the Office of Compliance Inspections within the SEC announced its intention to engage with registrants to assess LIBOR transition preparedness. This is an example of a regulator inquiry designed to promote the orderly transition from LIBOR to a replacement rate. It is possible these types of inquiries from regulators may continue until LIBOR sunset.

- On June 22, 2020, Edward Schooling Latter of the FCA is reported to have said “We know that Libor will continue until end 2021, but announcements about the discontinuation from the end of 2021 of Libor settings could come as early as November or December this year. Market participants need to be ready for that.” Schooling Latter was speaking at Risk.net’s Libor Virtual Week.

An official determination by the UK FCA that LIBOR is no longer representative could come well in advance of the actual cessation of LIBOR. This announcement of LIBOR no longer being representative–even though LIBOR has not ceased–would trigger the calculation of the spread adjustment under ISDA and ARRC fallback language. For instance, if the UK FCA officially announced on November 1, 2020 that LIBOR would cease at the end of 2021, then the spread adjustments for derivatives contracts and loans falling back from LIBOR to SOFR would be fixed on November 1, 2020.

- For lenders that manage an international portfolio, on June 23, 2020, the UK government announced it would pursue legislation to provide additional/revised powers to the FCA to ensure FCA can manage an orderly transition from LIBOR to a replacement rate. This is another step towards the eventual transition from LIBOR to a replacement rate. The FCA published the attached FAQ. https://www.fca.org.uk/markets/transition-libor/benchmarks-regulation-proposed-new-powers

- On June 30, 2020, the ARRC finalized its methodology for spread adjustment calculations. The ARRC will use a methodology that features a historical median of the difference between USD LIBOR and SOFR during a five-year lookback period. The ARRC is now working with potential vendors to publish the spread-adjustments.

NEWSLINK: Do you anticipate that any economic or policy shifts from COVID-19 may also impact the challenges associated with transitioning away from LIBOR?

PALLY: COVID-19 has undoubtedly impacted the real estate industry in the immediate term. In response, several lenders have had to shift resources. However, longer term LIBOR deadlines remain. Steady progress is key.

NEWSLINK: You serve as chair for MBA’s LIBOR Outreach Committee that supports commercial/multifamily members. Why are activities like these, trade association transition engagement broadly or even ARRC participation important?

PALLY: Active engagement with industry groups can be beneficial on many fronts. I am proud that since 2018, the MBA has educated its members on LIBOR transition. It’s an honor to chair the LIBOR Outreach Committee. The Committee has brought together institutions from different pockets of the mortgage market to share how each institution is handling the transition from LIBOR to a replacement index. Through sharing best practices, we aim to make the transition smoother for each MBA member. Under the leadership of the MBA, there have been numerous market calls, primers and resources offered to MBA members to keep them apprised of key market developments and suggested action steps.

At MetLife Investment Management, we continue to remain active among the many industry groups and associations looking at the transition to SOFR, including the Alternative Reference Rates Committee (ARRC) of the Federal Reserve and the CFTC’s Market Risk Advisory Committee’s Interest Rate Benchmark Reform Subcommittee.

Monitoring ARRC developments is helpful. Recently, the ARRC announced that they will be hosting a series of webinars titled “SOFR Summer Series” to help educate market participants of the transition from LIBOR to SOFR. https://web.cvent.com/event/05640e3a-a92c-4d5c-b7ef-6758f8f404a4/?rp=00000000-0000-0000-0000-000000000000

NEWSLINK: Are there any market developments or transition milestones coming up in the near term that you are monitoring?

PALLY: Aside from the ARRC Best Practices discussed above, I’d like to highlight a couple items. Earlier this year, the FHFA entities (Fannie Mae, Freddie Mac) announced they will cease purchasing LIBOR based loans by the end of 2020 and begin to accept SOFR Capped ARMs by end of 2020. For instance, Freddie Mac will not accept any LIBOR-indexed floating-rate loans that are taken under application after September 30, 2020. After December 31, 2020, Freddie Mac will no longer purchase LIBOR-indexed floating-rate loans, regardless of the loan application date or the date of the note. Industry participants believe this will be a material step towards decreasing LIBOR-based loans.

In July/August 2020, the ISDA Protocol is expected to be released. An adherence period for market participants will follow. The ISDA Protocol is relevant because it will essentially outline the triggers and fallbacks for converting existing LIBOR based derivative transactions to replacement rate transactions.

This fall, Bloomberg will begin to publish the spread adjustments to facilitate conversion of existing USD LIBOR loans to SOFR.

We believe these upcoming milestones will facilitate the final steps towards transitioning USD LIBOR loans and derivatives to SOFR. This fall, we anticipate continued market calls for the MBA community. Please stay tuned and reach out to MBA’s Andrew Foster (regarding commercial/multifamily implications), MBA’s Dan Fichtler (for single-family implications) or me with questions or suggestions.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)