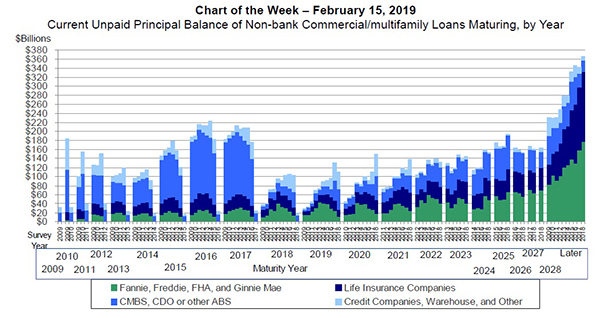

MBA Chart of the Week: Current Unpaid Principal Balance of Non-Bank Commercial/Multifamily Loans

Source: MBA CREF Database.

A decade ago, MBA began collecting information on volume of commercial and multifamily mortgages, held by non-bank lenders, maturing over the coming years.

The data foretold the “wall of maturities” in 2016 and 2017, and also anticipated the fall-off in 2018 and 2019–10 years after the lending lull seen during the Great Recession. This week’s chart, using data from our CREF Database, combines the results of multiple years’ surveys and provides a timeline of the changing nature of the market.

Zeroing in on the maturity year 2019, one can see the expanding volume of loans from 2009 until 2013, as 10-, seven- and five-year loans were put on. Then, two opposite forces begin to play. The unpaid principal balance of life company and GSE loans (which are generally longer-term in nature) maturing in 2019 began to decline as many of them are paid off or refinanced early. At the same time, loans maturing this year and held in commercial mortgage-backed securities, mortgage real estate investment trusts, debt funds and other shorter-term capital sources started to increase–with a particular jump coming from two-year loans made in 2017.

Other years tell different stories. This includes a major surge in two-year loans made in 2018 and maturing in 2020 by investor-driven lenders such as debt funds and mortgage REITS; a jump in seven-year loans made in 2017 and 2018 and maturing in 2022 and 2023 by the GSEs; and steady refinancing and pay-offs of GSE loans set to mature through 2022.

Commercial mortgages tend to be relatively long-term in nature. As a result, aggregate maturities are spread out over a great many years.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)