JLL Secures $280M To Refinance Empire Stores in Brooklyn

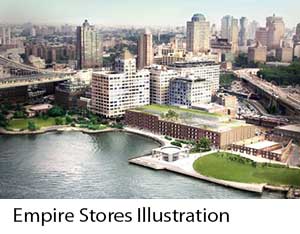

JLL, Chicago, secured $280 million for Midtown Equities and HK Organization to refinance Empire Stores, a newly redeveloped retail and office building in Brooklyn, N.Y.

Home to numerous tech startup firms, Down Under Manhattan Bridge Overpass or DUMBO is Brooklyn’s most expensive neighborhood.

Home to numerous tech startup firms, Down Under Manhattan Bridge Overpass or DUMBO is Brooklyn’s most expensive neighborhood.

AIG, New York, provided the 15-year loan.

JLL Vice Chairman Aaron Appel, Managing Director Jonathan Schwartz, Executive Vice President Jackson Sastri and Vice Presidents David Sitt and Eliott Zeitoune led the debt placement team.

The Empire Stores adaptive reuse project renovated seven contiguous four- and five-story historic warehouses totaling 347,000 gross square feet. The warehouses date to between 1869 and 1885 and were primarily used for coffee storage until they were abandoned in the 1960s. A team led by Midtown Equities entered into a 96-year ground lease of the site in 2013.

The six-story Class A property on the East River Waterfront at 55 Water Street now totals 378,000 square feet of office space and 65,000 square feet of ground-floor retail.

JLL’s Capital Markets team also sold 266-unit apartment community Sanctuary on 22nd in Phoenix for $31.8 million. JLL Managing Directors John Cunningham and Charles Steele represented seller Laguna Point Properties, Laguna Hills, Calif., when the property sold to a private investor.

“Sanctuary on 22nd is a significant value-add opportunity in an area with high demand and minimal new multifamily construction,” Steele said. “That, combined with its close proximity to Interstate-17 and Light Rail, make Sanctuary on 22nd a very well-positioned asset in one of the healthiest local apartment markets in the country.”

Built in 1985, Sanctuary on 22nd’s units average 788 square feet. The community occupies 10 acres between Dunlap and Northern Avenues, less than one-half mile from Interstate 17.