Office Vacancy Holds Steady; Tenant Improvement Allowances Up

Vacant office space held steady at 13 percent during the second quarter, but concession and tenant improvement packages continue to rise as landlords pursue new tenants, CBRE and JLL reported.

“The office market remained in equilibrium during the second quarter with supply and demand roughly in balance,” said CBRE Americas Chief Economist Jeffrey Havsy.

Havsy noted office absorption remained in the 7 million square-foot range for three of the past four quarters while supply growth has ranged between 10.5 million and 11.8 million square feet over the same period. “This steadiness has kept the overall vacancy rate near 13 percent over the past year,” he said.

Suburban office vacancy rates increased by 10 basis points during the quarter to 14.3 percent while downtown vacancy remained steady at 10.7 percent, Havsy reported. “Vacancy continued to fall in an about half of the U.S. office markets, and the national office vacancy rate remains near its post-recession low,” he said.

The largest quarterly vacancy declines occurred in Columbus, Ohio (170 basis points), Las Vegas (160 basis points) and Albuquerque, N.M. (130 basis points), CBRE reported. Louisville, Ky., Jacksonville, Fla., Norfolk, Va. and Orlando, Fla. each declined by 60-plus basis points.

Over the past four quarters, market conditions tightened notably in many mid-sized markets including Tucson, Ariz., Sacramento, Calif., Albuquerque and Raleigh, N.C., CBRE said.

JLL, Chicago, noted that new construction is altering the office landscape, bringing more space options to the market, but at “substantially” higher rents. JLL reported 11.7 million square feet of new deliveries during the quarter and rents at newly delivered buildings averaged 41 percent more than the broader Class A average.

JLL, Chicago, noted that new construction is altering the office landscape, bringing more space options to the market, but at “substantially” higher rents. JLL reported 11.7 million square feet of new deliveries during the quarter and rents at newly delivered buildings averaged 41 percent more than the broader Class A average.

“As tenants flock to new quality supply, we’ll continue to see slightly higher vacancy and subdued absorption of second-generation space,” the JLL Office First Look report said.

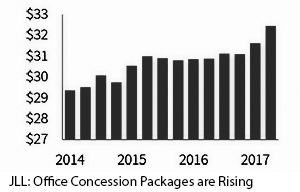

JLL also noted tenant improvement allowancesand concessions have jumped 10.5 percent since 2014 as office landlords face a more competitive leasing environment. “Increased concessions are helping reduce the pain tenants are feeling as a result of rising face rates,” the report said.