Commercial and multifamily developments and activities from MBA important to your business and our industry.

Category: News and Trends

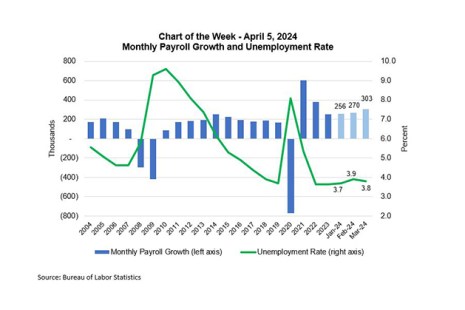

U.S. Adds 303,000 Jobs in March

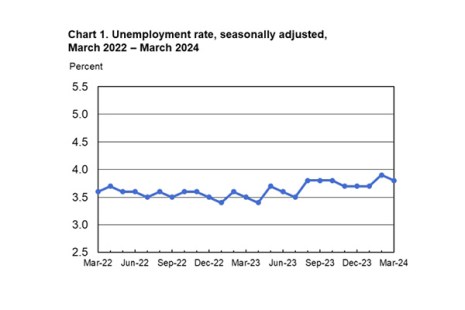

Total nonfarm payroll employment grew by 303,000 in March, per the U.S. Bureau of Labor Statistics.

MBA Chart of the Week: Payroll Growth and Unemployment

Our Chart of the Week focuses on Friday’s Employment Situation report released by the Bureau of Labor Statistics.

MISMO Seeks Public Comment on Two Issues

MISMO, the real estate finance industry’s standards organization, is seeking public comment on two issues, the previously published IRS 4506-C dataset and the Ability to Repay Decision Model and Notation white paper.

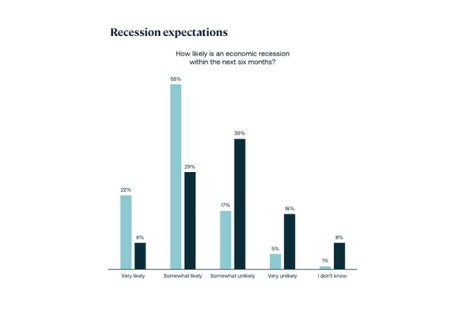

Altus Group Survey: Increase in Prioritizing ‘Deploying Capital’ in Near Term

Altus Group, Toronto, released its Commercial Real Estate Industry Conditions and Sentiment Survey for Q1, finding U.S. respondents who expect their primary focus to be deploying capital in the next 6 months grew from 7% at the end of 2023 to 25% in the most recent quarter.

Dealmaker: Mesa West Capital Funds $81M Loan for Boston-Area Multifamily Community

Mesa West Capital, Los Angeles, provided a joint venture between Toll Brothers and Carlyle with an $81 million loan to refinance Emblem 120, a 289-unit mid-rise multifamily property in Woburn, Mass.

Commercial and Multifamily People in the News April 11, 2024

Industry personnel news from Peachtree Group, JLL and Greystone.

CMF Quote of the Week: April 4, 2024

“Rent control has consistently proven to be a failed policy that discourages new construction, distorts market pricing, and leads to a degradation of the quality of rental housing – the exact opposite of what is currently needed in markets throughout the country,”

–MBA President and CEO Bob Broeksmit, CMB on the planned announcement to impose a 10% limit on annual rent hikes at properties supported by LIHTC

CREF Policy Update April 4: MBA Releases 2023 Rankings of Commercial/Multifamily Mortgage Firms’ Origination Volumes

Commercial and multifamily developments and activities from MBA important to your business and our industry.

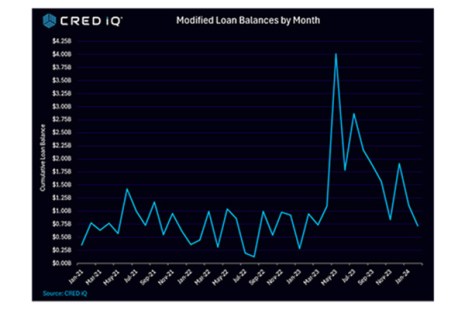

CRED iQ: Commercial Loan Modifications Surged in 2023

CRED iQ, Wayne, Pa., reported the number of commercial loan modifications jumped significantly in 2023 from 2022. And, the firm anticipates that trend will persist in 2024.